Economy Recovers as OPEC+ Ease Oil Cuts

On Wednesday, OPEC+ agreed to ease oil supply curbs that occurred in August, in turn dropping oil prices. As the economy tries to rebound from the COVID-19 pandemic, there are fears that the virus could unleash a second wave and compromise the slowly rebounding market. Since May, OPEC+ have cut output by around 10% of the global supply of oil due to fact that coronavirus wiped out over 20% of global fuel demand.

Stocks rallied on Wednesday after a report from Moderna, Inc. said they confirmed successful COVID-19 vaccine trial tests. Throughout the day, the S&P 500 reported a 29 point gain, or just under 1%. On July 27, Moderna reported that they will be conducting a 30,000 person clinical trial. Positive results from the trial will further solidify the possibility of a successful vaccine entering the marketplace. Driven by the thought of an eventual coronavirus vaccine, the market continues to rebound from the devasting effects of COVID-19.

The EIA reported a decrease for crude inventories of 7.5 MMbbls, versus an expected decrease of 2.1 MMbbls. In addition to the headline crude draw we reported yesterday, distillates also reported a surprise draw, though stocks remain 26% above the five-year average. Diesel demand rose by 673 kbpd to 3.7 MMbpd last week, still down about 1 MMbpd from the levels reported before lockdown. The EIA reported the diesel draw after the API estimated an increase of 3.0 MMbbls. There is still a demand for diesel, showing that demand is rising and the economy is also getting better after reports of a eventual COVID-19 vaccine. Gasoline reported a draw in stocks and is now just 7% above the five-year average.

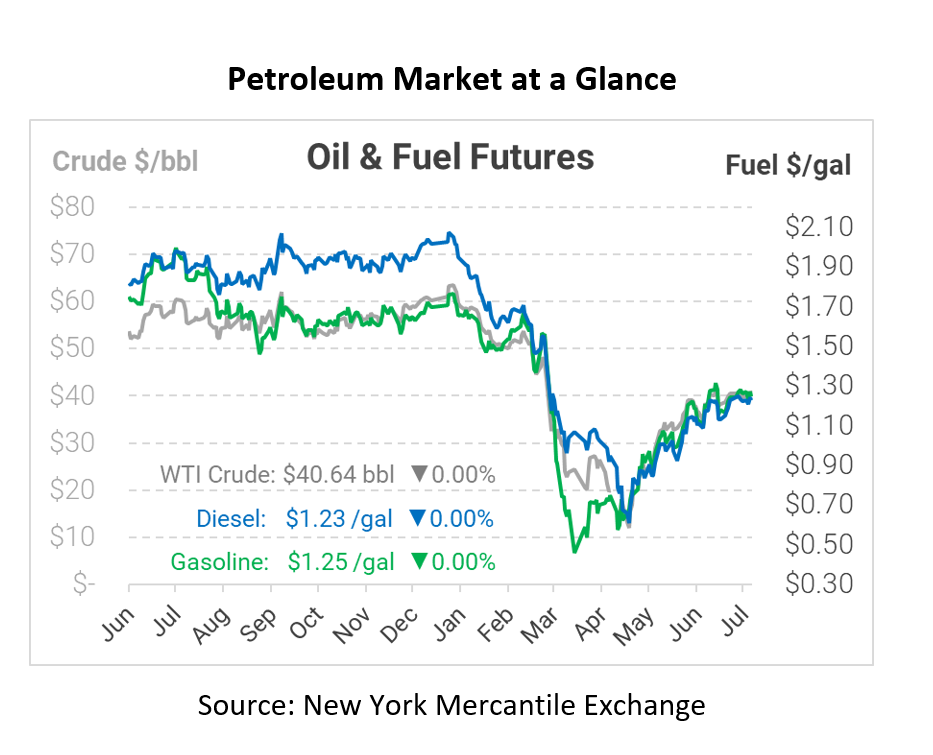

Crude prices are down this morning. WTI Crude is trading at $40.64, a loss of 56 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.2301, a loss of 1.5 cents. Gasoline is trading at $1.2477, a loss of 1.7 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.