Economic Optimism Hits Record High Despite Rise in Gas Prices

by National Association of Consumer Stores

Despite rising gasoline prices, three in five (61%) gasoline consumers report feeling optimistic about the state of the economy, according to the latest National Association of Convenience Stores (NACS) Consumer Fuels survey. Consumer optimism is at an all-time high across the four-plus years the national survey has been conducted, surpassing the 58% economic optimism recorded in December 2016 following the presidential election.

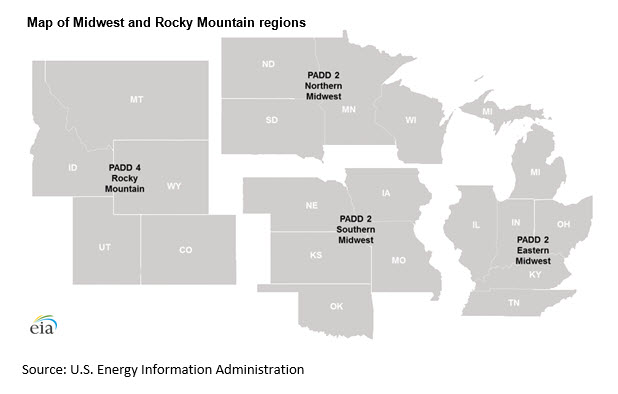

A majority of Americans are optimistic across all demographics examined. Older Americans age 50 and older are the most optimistic age group (65% optimistic), compared to 55% of those ages 18-34 who are optimistic. There also are regional differences, with Southerners reporting the highest levels of economic optimism (64%) and Midwesterners reporting the lowest (56%).

Americans also report a 4-cent rise in gas prices in their area. The reported median gas price of $2.29 brings gas prices back up to where they were at the beginning of the year, when gasoline consumers reported a median price of $2.30 (January 2017). Price increases are being felt the most strongly in the West, where a majority (52%) report seeing gas prices higher than they were last month. By comparison, just 41% of gas consumers in the Northeast and the South report seeing higher gas prices this month.

A majority of gasoline consumers expect prices to continue increasing in the next month, a time when gas prices generally face upward pressure as the fuels industry undergoes the annual transition to producing summer-blend fuel. Half (51%) of all Americans say that they expect prices in 30 days to be “much higher” or “somewhat higher” than they are today. Just one in ten (9%) expect prices to drop in the coming month.

Traditionally, rising prices have an inverse effect on consumer optimism. In March 2013, when 85% of Americans said that gas prices had increased, optimism stood at only 41%. However, gas prices also were much higher in March 2013 ($3.58).

The strong optimism may also translate into increased sales for convenience retailers: One in five consumers (22%) say they will drive more this coming month and 19% say they will shop more. More than three in four consumers (76%) say that gas prices have an impact on their optimism.

“The strong consumer optimism is also great news for convenience store retailers, who generally see sales grow when consumers are feel good about the economy, gas prices are low and the weather is nice. It appears that consumers are ready to unleash that optimism with more spending,” said Jeff Lenard, NACS vice president of strategic industry initiatives.

And there is one more factor that can help grow sales for convenience stores: This past weekend’s change to Daylight Saving Time, which adds an extra hour of daylight to evening hours.

“With the extra hour people stay out later, and outdoor activities pick up — as do our sales. The time change equates to an immediate 10% lift in sales,” said E-Z Mart Stores CEO Sonja Hubbard (Texarkana, TX).

The survey was conducted online by Penn Schoen Berland; 1,102 U.S. adults who purchase fuel for a vehicle such as a car, truck or van at least once per month were surveyed March 7-9, 2017.

Founded in 1961 as the National Association of Convenience Stores, NACS (nacsonline.com) is the international association for convenience and fuel retailing. The U.S. convenience store industry, with more than 154,000 stores across the country, conducts 160 million transactions a day, sells 80% of the fuel purchased in the country and had total sales of $575 billion in 2015. NACS has 2,100 retail and 1,700 supplier member companies, which do business in nearly 50 countries.

This article is part of Uncategorized

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.