Easing Trade Tensions

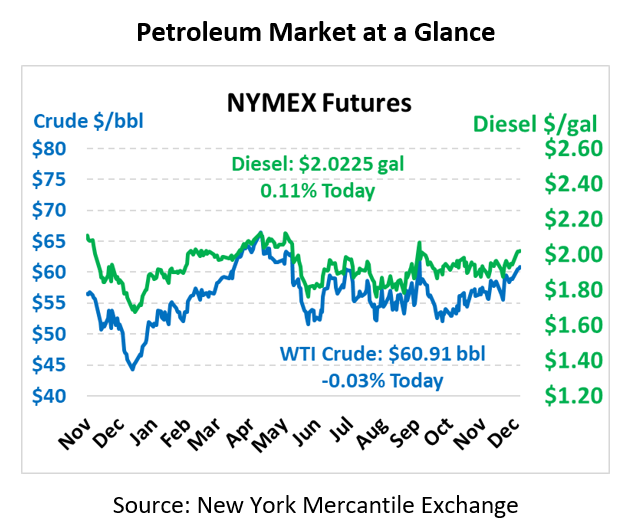

Oil prices are relatively unchanged this morning. WTI Crude is trading at $60.91, a loss of 2 cents.

Fuel is up in early trading this morning. Diesel is trading at $2.0225, a gain of 0.2 cents. Gasoline is trading at $1.6930, a gain of 0.9 cents.

On Wednesday, crude prices closed flat after trading lower earlier in the session. Markets were lifted by more easing of US-China trade tensions. China’s finance ministry published a new list of six chemical and oil products from the US that will be exempt from tariffs starting on December 26th. In addition, the EIA inventory report was bullish when compared to the API report.

The EIA reported a draw for crude of 1.1 MMbbls, verses an expected draw of 1.3 MMbbls. The EIA numbers were bullish in comparison to the API estimate of a large build. At Cushing, the EIA reported a 3.4 MMbbl draw. The EIA reported distillates had a larger-than-expected build and gasoline also saw a larger-than-expected build. However, products builds were smaller than API estimates giving the EIA data a bullish tint. Markets were mixed as the inventory data was absorbed.

Yesterday, in a near party-line vote in the House of Representatives, President Trump became the third US President in history to be impeached. What comes next is a trial in the Senate that could, but probably won’t cost him the White House. So far markets have not reacted and appear to expect proceedings to die in the Senate.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.