Doubts About Demand Recovery Pressures Markets

On Wednesday, WTI Crude saw choppy trading action, but ended up relatively flat. Today prices are retreating from three-month highs on news of disunity among OPEC+ members regarding extending production cuts. While Saudi Arabia and Russia have reached a preliminary agreement, momentum is being disrupted by cheating by Nigeria and Iraq.

OPEC cheating has been a common refrain throughout the history of the organization – every producer has an incentive to increase production to take advantage of higher prices and gain market share. Historically, the punishment for cheating has been either public shaming or Saudi Arabia flooding the market with cheap product to take back market share. Earlier this year, a dispute between Saudi Arabia and Russia resulted in Saudi Arabia flooding the market. Both major producers have a strong incentive to stay the course, but smaller producers cheating could eventually change their decision calculus.

Also dragging down markets are doubts regarding the magnitude of demand recovery. For distillates, demand fell 550 kbpd week over week and exports dropped off 150 kbpd. While the EIA reported crude stocks drew by 2.1 MMbbls, products built by a large margin. The headline yesterday was the size of the diesel inventory gains. Diesel production has been declining, so such a large build in inventories is surprising.

The EIA reported a surprise decrease for crude of 2.1 MMbbls, versus an expected increase of 3.0 MMbbls. At Cushing, the EIA reported that stocks fell by 1.7 MMbbls. US crude oil inventories are about 12% above the five-year average for this time of year. Distillates reported a larger-than-expected build and are trending about 28% above the five-year average. Gasoline reported a surge in stocks and is about 10% above the five-year average.

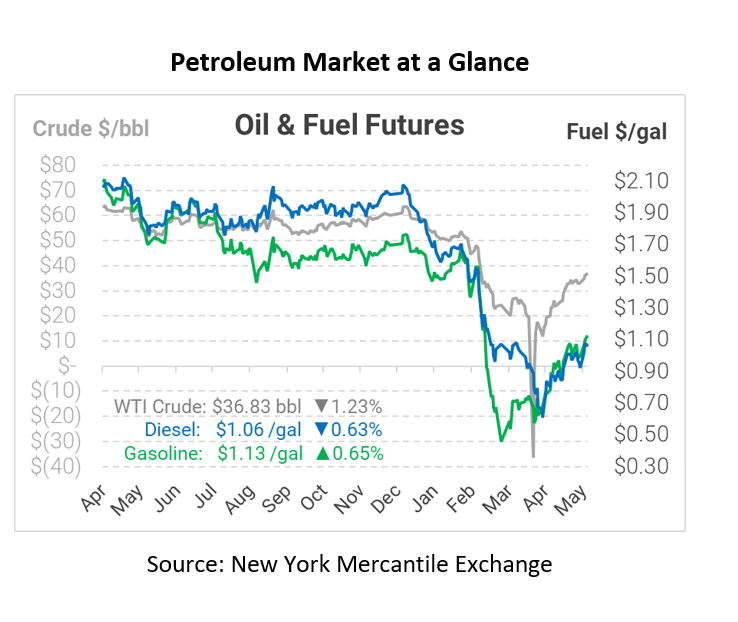

Crude prices are flat this morning. WTI Crude is trading at $36.83, a loss of 46 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $1.0579, a loss of 0.7 cents. Gasoline is trading at $1.1266, a gain of 0.7 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.