Dorian to Hit Florida, Prices Flat Despite Bullish Data

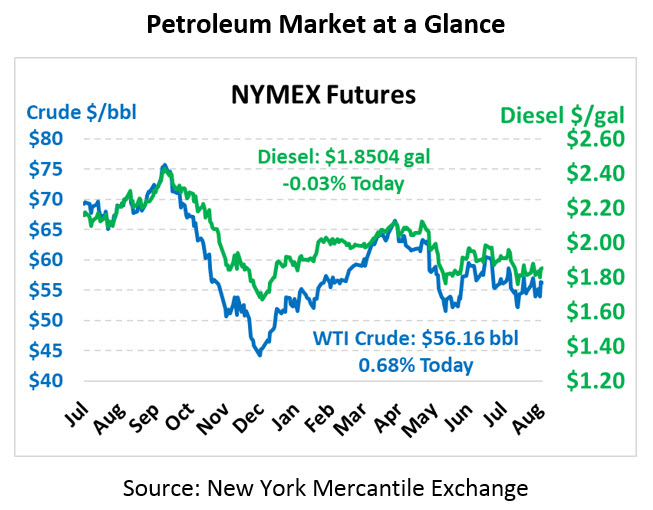

The EIA’s data released yesterday morning lifted oil prices from its slump earlier this week. In fact, the whole oil complex received a solid boost from the report. Crude oil is trading at $56.16 this morning, up 38 cents.

Fuel prices moved higher in their own rights, up 3.5 cents and 4.2 cents for diesel and gasoline, respectively. Today’s results are a bit more mixed. Diesel prices are hovering flat, trading at $1.8504. Gasoline prices are dropping this morning, trading at 1.6724 after shedding a penny.

The EIA’s report generally confirmed the API’s numbers while taking an even more bullish gasoline bent. The headline draw for crude oil noted 10 million barrels less crude in American inventories, with every region of the country experiencing steep draws. Both gasoline and diesel inventories fell by over 2 million barrels.

A hefty dip in imports for the week contributed heavily to the draw, particularly in PADD 2 Midwest where crude inventories fell by 4.9 million barrels. In fact, the weekly imports level was the second lowest level since 1996 – only Feb 2019 saw a lower import level. Imports and exports can be highly affected by short-term logistics issues, such as barges coming and going or pipeline batch shipments. While this week’s low imports number was likely a fluke based on timing, imports have been steadily declining since peaking in 2004.

Looking regionally, the former CEO of Philadelphia Energy Solutions is attempting to purchase and restart the PES refinery, which was shut down in June. Many had expected the refinery to remain offline for some time (or permanently, with the site converted to storage). If the refinery is brought back online, it could help alleviate some supply tightness in the Northeast, leading prices to ease a bit. PES is part of a long string of refineries in the Northeast that have shut down over the past decade due to competitive pressures.

Hurricane Dorian

Hurricane Dorian is quickly gaining strength as it sets sight on Central Florida. NOAA expects the storm to strengthen to a Category 3 before making landfall somewhere in the middle of the Sunshine State, weakening to a Category 2 as it continues inland and quickly declining from there. The storm has pushed further north than expected, keeping it away from Caribbean islands and providing more time to strengthen in the warm waters of the Atlantic.

Current forecasts show the storm stalling as it approaches the Florida coastline, which could spell trouble if it proves accurate. Slow storms give the system ample time to dump water – and as we saw a couple years ago with Hurricane Harvey, rain can prove more devastating than heavy winds. This far in advance, though, it’s hard to accurately predict the storm’s speed and strength.

From a fuel standpoint, Florida is virtually entirely isolated from the rest of the country’s fueling infrastructure, so any localized impact shouldn’t be felt nationally. For locals, the strength and speed of the storm will determine the local affect – in general, expect higher fuel demand ahead of the storm followed by weaker demand afterwards. Power outages may impact local fuel terminals for some period, with downtime dependent on the damage done to electric infrastructure.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.