Dollar Driving Oil Rally

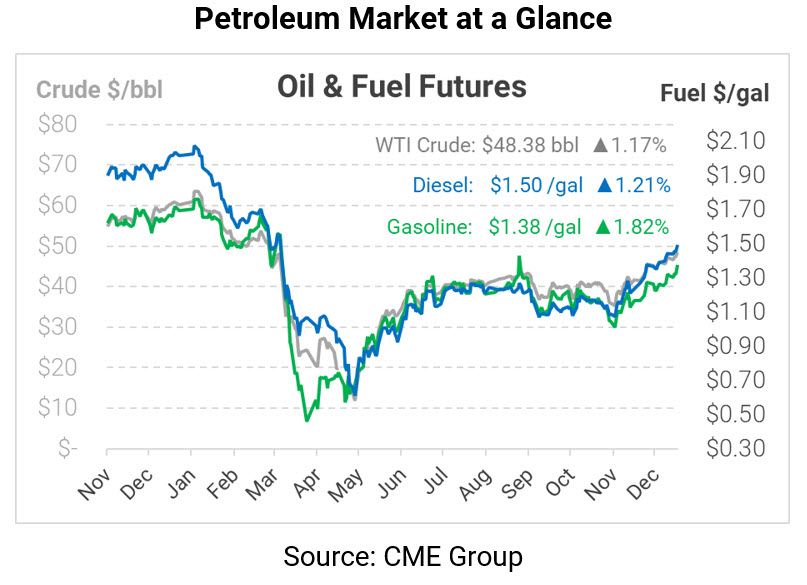

Yesterday’s EIA report sent markets into yet another climb, with WTI crude surpassing $48/bbl for the first time in months. In addition to vaccine news and a bullish EIA report, markets are also benefiting from hopes of a coronavirus stimulus bill passing through Congress before the end of 2020, which would give the economy a boost and stimulate fuel demand.

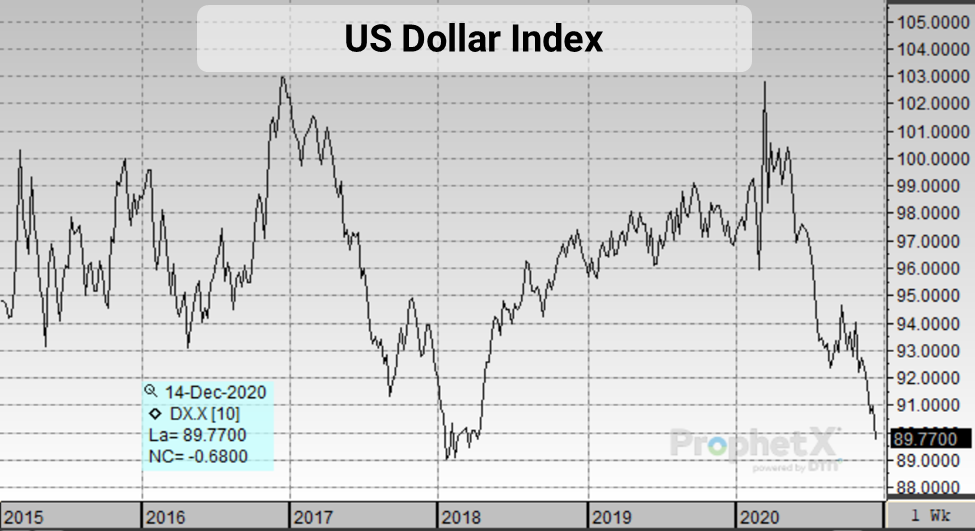

Behind the scenes, the US Dollar has been another critical factor impacting oil prices. The USD has an inverse relationship with crude oil prices. As the dollar’s value falls, foreign oil buyers can buy more contracts with the same amount of foreign currency, driving up demand and prices. During the pandemic, economic concerns caused a flight to the dollar that drove the USD to 3-year highs. Now, a worldwide recovery has sent the dollar to multi-year lows, driving oil prices higher at the same time.

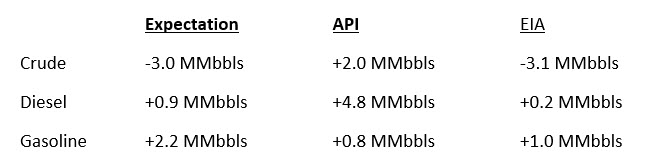

Unlike the API’s report, which was universally bearish for prices, the EIA’s data was more supportive for oil prices. Crude posted a draw that exceeded expectation, while gasoline and diesel builds were smaller than expected. Refinery utilization also dipped slightly, even as crack spreads slowly improve.

Oil prices are continuing to rise as the dollar sinks and positive news keeps rolling in. WTI crude is trading at $48.38/bbl, up 56 cents (1.2%) from Wednesday’s closing price.

Fuel prices are also moving higher, bring crack spreads along with them. Diesel prices are $1.4958, a gain of 1.8 cents (1.2%) over yesterday’s close. Gasoline is trading at $1.3775 currently, up 2.5 cents (1.8%). Together, the product gains have brought 3:2:1 crack spreads back above $11/bbl for the first time since August.

This article is part of Daily Market News & Insights

Tagged: Inventories, US Dollar

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.