Diesel Hits 12-Month Low – Are More Headwinds Coming?

Crude oil prices have dropped from their recent highs, partly due to concerns about a potential oversupply and lower demand for heating oil as the winter weather eases. In addition, there are plans to sell more crude oil from the Strategic Petroleum Reserve, which could further increase supply and potentially put downward pressure on prices.

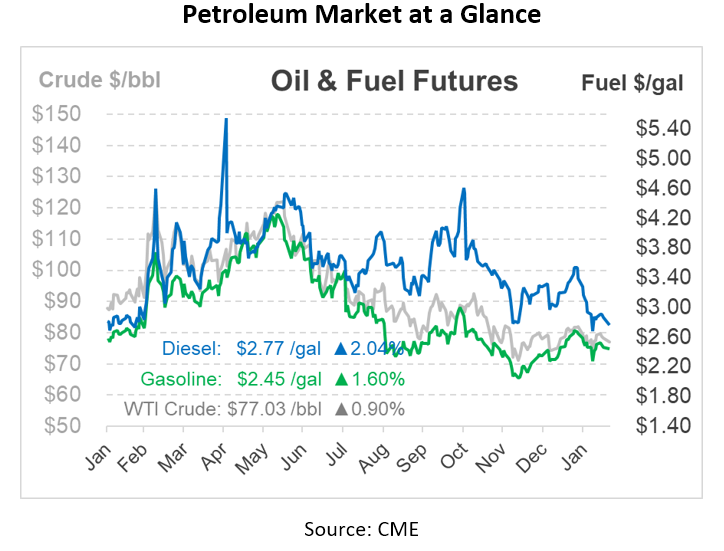

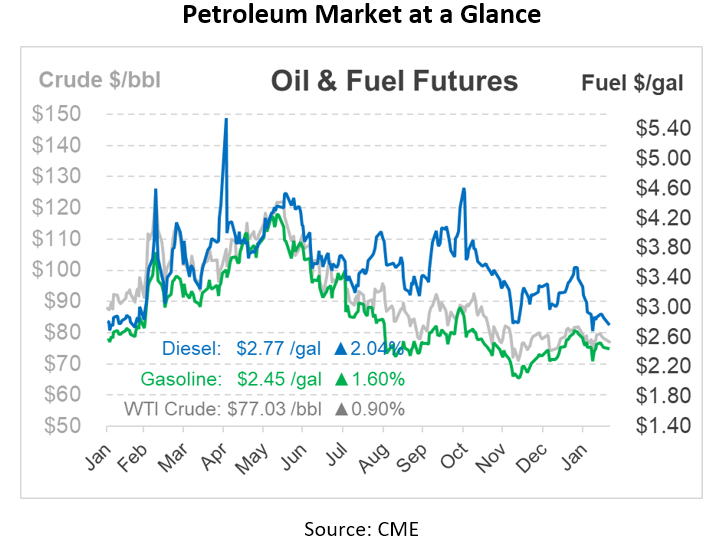

The market has had a lot of ups and downs over the past week due to recent inflation data and continued fears of a recession. Diesel prices fell 16 cents last week to the lowest level in over a year, and gasoline ended down by a dime. While the market is closed today in observance of President’s Day, there are still some things to keep in mind as you navigate the week ahead.

Demand for heating oil is not being driven up by winter weather, which has kept supply stable. Entering the 2022-23 winter, there had been concerns that a cold winter could exacerbate low diesel inventories and cause price spikes. Fortunately, these have not materialized, and with spring around the corner, markets are growing more confident. Refiners are beginning to prepare for the upcoming spring and summer driving season, when utilization turns higher. Because of this, oil consumption will likely stay low until refining capacity is ramped up.

An Ohio refinery announced it would resume operations in Q2 2023, adding 160,000 b/d back to US refining capacity, which could further affect supply and prices. The region has been experiencing supply challenges due to the outage, so a surer timeframe for repairs may add some stability for prices.

While hawkish indications from Federal Reserve officials compounded economic fears, oil reversed its longest run of daily losses this year. As US crude inventories continue to build up, the federal government has plans to further deplete the stockpile, increasing the headwinds.

Although the Biden Administration sought bids to replenish the Strategic Petroleum Reserve, it may now have to sell more crude oil with anticipated deliveries to take place between April and June. The sale could amount to 26 million barrels of petroleum and is a component of the congressionally mandated sale that was approved for the current fiscal year back in 2015. The Energy Department has attempted to halt some of the sales from the 2015 legislation so that the US could replenish the SPR. The reserve is expected to drop to 345 million barrels after the most recent release.

It’s also worth noting the recent legislation approved by the US House to limit the Energy Secretary’s use of the SPR unless additional federal lands were made available for oil and gas extraction. In December, lawmakers accepted a clause to a massive budget bill that would cancel mandated releases of the 140 million barrels scheduled for 2024 through 2027. As always, it’s important for investors to stay informed and keep a close eye on developments in the oil industry and related markets.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.