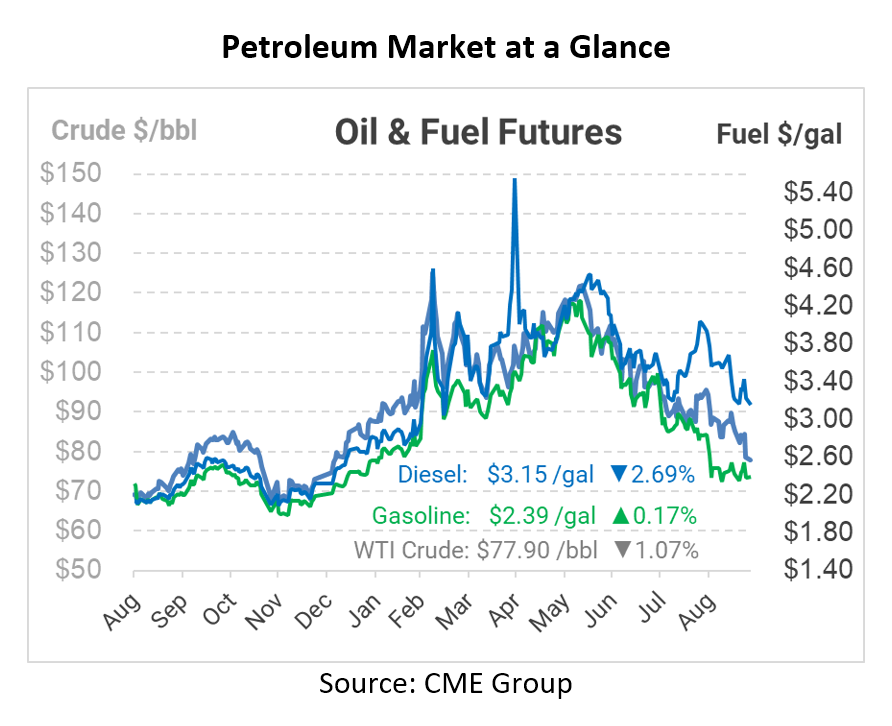

Diesel Demand Sinks, Pushing Market Prices Lower

After closing Friday below $80/bbl for the first time since January, crude markets are continuing their selloff. CFTC data shows that all oil products are seeing reduced buying among institutional investors (hedge funds, money managers, etc), with diesel demand shedding the equivalent of 39 million barrels of holdings over the past 3 weeks.

Demand data seems to echo market sentiments. Over the past two weeks, diesel demand has shown a sharp drop, posting the two lowest levels of 2022. Throughout the year, demand has shown a steady decline but remained within the “healthy” range between 3.5-4.5 MMbpd. The latest readings have been as low as 3.2 MMbpd, a sharp break from historical levels and more in tune with COVID-19 levels.

On the more bullish side, the US is bracing for a major hurricane set to make landfall this week. Hurricane Ian will hit on Wednesday or Thursday, bringing heavy rain and strong winds to Florida and the Gulf Coast. Most offshore oil rigs are further west in the Gulf of Mexico, so the impact on oil production should be minimal. Florida’s supply markets are connected to the rest of the country by barge, rather than by pipeline, so delayed barge shipments are the only major impact expected to arise due to Hurricane Ian.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.