Despite Bearish Data, Oil Markets Rise

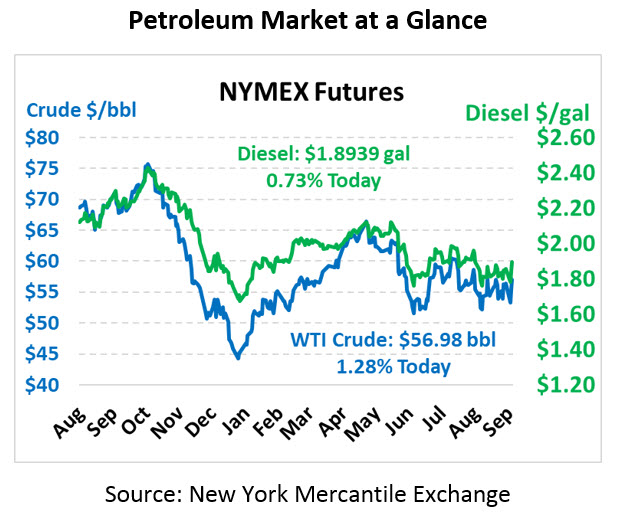

Oil prices are continuing their ascent this morning following yesterday’s lofty 4.3% gains. Prices are at their highest level in weeks, though it’s worth mentioning that WTI crude prices have not deviated from their $50-$60 band since May. Today, crude prices are currently $56.98, up 72 cents from yesterday’s closing price.

Fuel prices are up as well, following crude markets higher. Diesel prices are currently $1.8939, up 1.4 cents. Gasoline prices are $1.5428, a penny gain.

The API’s report was underwhelming for markets, posting both a surprise build for crude and a surprise draw for diesel inventories, while gasoline was in line with expectations. With the results relatively close to unchanged, markets have generally brushed off the report, waiting to see if the EIA’s data provides a more interesting view.

ExxonMobil is stirring headlines this morning with its report that it is actively eyeing acquisitions in the oil and gas sector, a break from the clean energy trend that oil majors have been moving to. CEO Darren Woods noted that the transition to clean energy will take decades, and oil demand will rise in the meantime. Woods also commented that the company is seeking value as oil prices move to the bottom of the price cycle – which begs the question of whether the oil giant thinks we’re currently at the bottom.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.