Despite Bearish Data, Oil Complex Rises

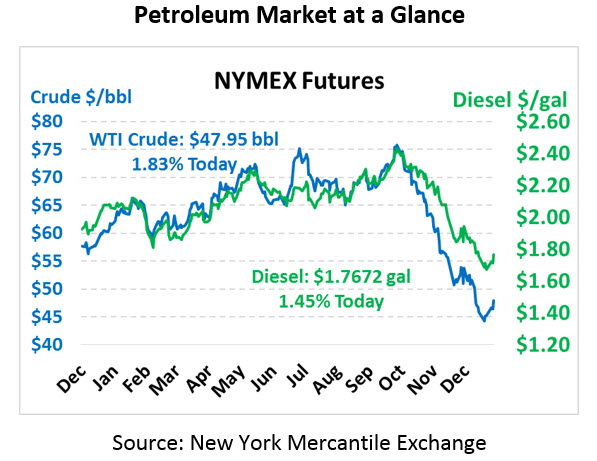

A bearish EIA report was not enough to slow the ascent of oil prices this morning as OPEC’s cuts gain credibility. Prices are hitting multi-week highs after an extremely low stint over the holidays. This morning WTI crude oil is trading at $47.95, up 86 cents from Thursday’s close.

Fuel prices are also climbing this morning. Diesel prices are trading at $1.7672, up 2.5 cents from yesterday’s close. Gasoline prices are $1.3522, clinging to meager 0.3 cent gains.

The API released their weekly numbers yesterday, and the EIA produced their report this morning – both delayed by the holidays. The EIA’s data showed supplies significantly looser than in the API’s data. Rather than drawing, crude stocks held steady, while refined products posted huge builds. The numbers were generally seasonal, though the huge build for distillate stocks was a big surprise resulting from diesel demand falling 1 million barrels per day compared to last week.

Despite the bearish data, markets are more focused on what’s to come. Renewed belief in OPEC’s ability to balance markets has prices rallying. Iraq announced plans to hold output steady at rates below November’s level. Adding to the rally is new hopes that the US and China might work out their on-going trade dispute. China indicated that talks with the US will resume in Beijing on Jan 7-8.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.