Demand Destruction – What China’s COVID Spike Means for Oil

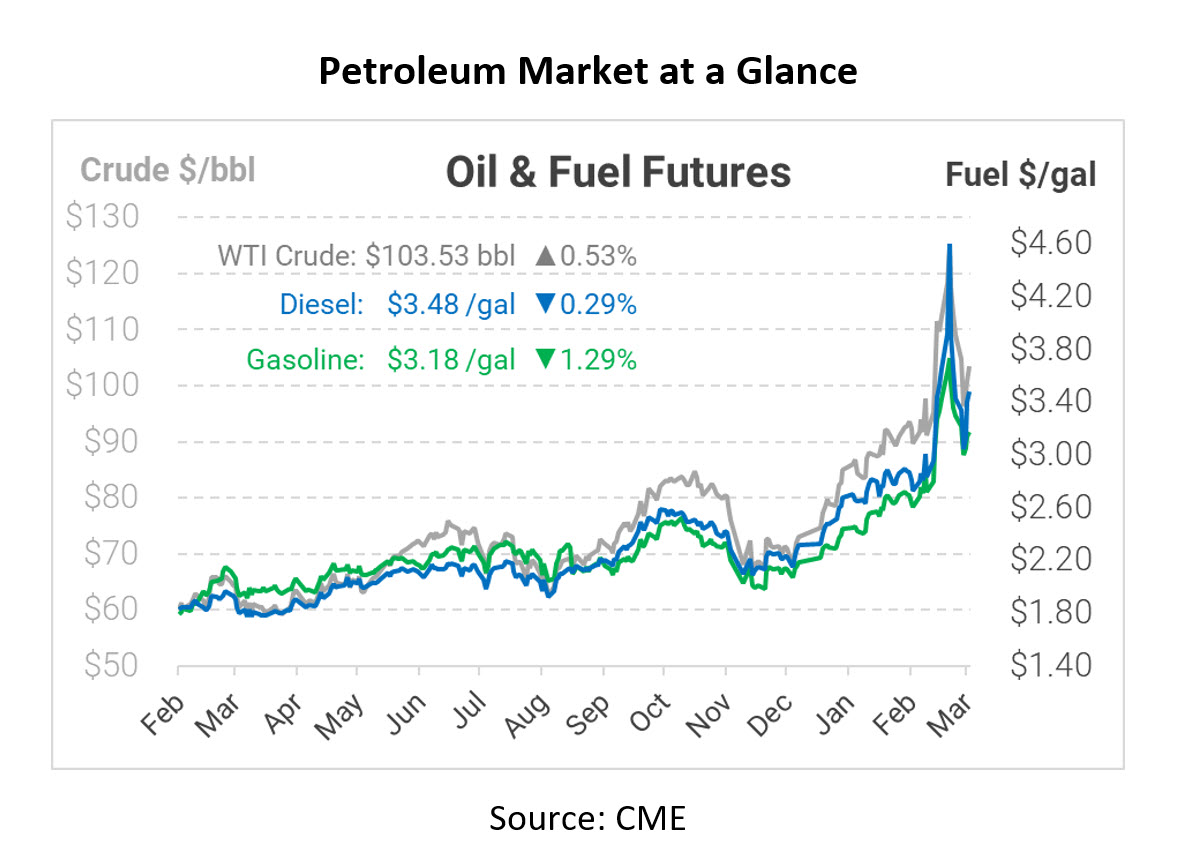

Many analysts have written lately about high oil prices, noting that with supplies cutoff, the only balancing mechanism is demand destruction. Typically, demand destruction comes in a few different forms – either interest rates rising and limiting borrowing, or prices going so high that customers must buy fewer goods. Right now, though, the world has one other form of demand destruction – pandemic lockdowns. China’s recent decision to restrict travel caused a large drop for fuel prices, though they’ve since recovered.

The most recent wave of COVID-19 cases was nearly 4x larger than the previous peaks, though Omicron was far less deadly than its predecessors. With the world largely returning to normal, the coronavirus faded from headlines for a while, but it’s slowly coming back once again. Global COVID-19 cases have stopped their downward progress, rising since early March. China’s current outbreak has reached as many as 2,000 new cases per day – the largest spike since the virus was originally uncovered in Wuhan. The EU is also reporting an uptick. In more positive new, the daily death toll of COVID-19 is at its lowest point since October 2020, which shows that the virus has become more prolific but less harmful.

Whatever form it takes, demand destruction is usually painful for global consumers. Rising interest rates limit borrowing, which means less business investment and ultimately fewer new jobs created. Whether its due to high prices or pandemic restrictions, consumers staying home and not spending also slows economic activity. For oil prices, all this typically means lower fuel prices eventually. But we’re unlikely to see demand fall nearly as much as in 2020, and suppliers don’t seem to have capacity to keep up even if demand softens a bit. There’s a possibility that oil could rise much higher, causing much more severe cutbacks from drivers, before prices improve.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.