Delays for IMO 2020? Unlikely

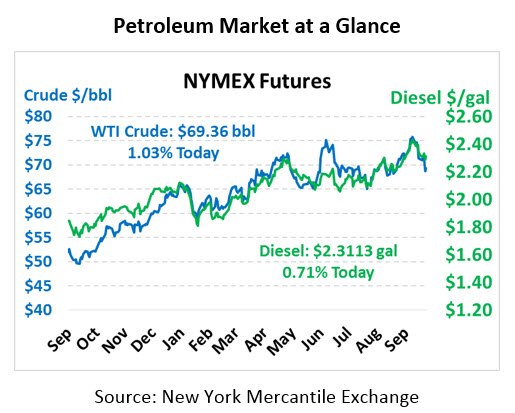

Oil prices are finally getting a reprieve this morning after significant losses this week brought crude below $70 for the first time in a month. WTI crude is currently trading at $69.36, picking up 71 cents since yesterday’s close.

Fuel prices are also getting a boost this morning. Diesel prices are trading at $2.3113, up 1.6 cents from Thursday’s close. Gasoline prices are $1.9185, gaining 2.7 cents.

Globally, the pressure continues to build as Iran’s output in early October was 2.2 MMbpd – just slightly below April’s peak of 2.4 MMbpd and well above the 1.6 MMbpd reported in September. As countries from the EU to India and China race to find ways to continue buying Iranian crude, markets fear countries will ignore sanctions come November and continue purchasing Iranian crude. On the flip side, the pick-up in Iranian exports could simply be a pre-sanctions rush to fill storage tanks before cutting off purchases. Time will tell whether America’s sanctions will truly get Iranian exports close to the “zero” level as threatened by the US State Department.

Next week, the UN IMO will be meeting, and one of the topics will certainly be the radical reduction in marine fuel sulfur contents in 2020 (for more background, check out our article on IMO 2020). The Wall Street Journal recently reported the White House is pushing for a small delay in the regulatory change, which would allow suppliers to sell down their inventories of high-sulfur crude after the bill takes effect. So far, the UN has been adamantly opposed to any delay measures, and the White House hasn’t exactly been building its political capital with the organization late – making it an uphill battle for Trump. The proposed delay would not significantly alter the roll-out of IMO 2020, but could perhaps smooth the transition. Stay tuned for more IMO 2020 details.

On the fuels front, President Trump has been working for weeks to finalize a proposal to allow E15 gasoline sales all year long. Currently, 15% ethanol blends are banned during the summer due to concerns over smog, but renewables advocates have been pushing for some relief. The EPA is expected to finalize their proposal by February. The move would significantly improve adaptation rates of E15 – a fuel which is usually cheaper than E10 gasoline and is approved for regular use in any vehicles made in 2001 or later. Today, gas stations are hesitant to install the infrastructure for E15 fuel since it’s only available during half of the year; a full-year permit would allow those stations to invest in creating the infrastructure to offer E15 along with E10 and premium blends.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.