A Military Exercise in the Middle East

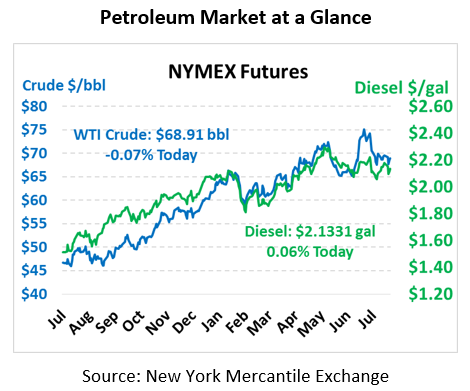

Crude oil is taking a pause this morning following yesterday’s rally. Prices opened the day lower on Thursday before making a complete reversal and heading higher after the EIA reported a large draw in Cushing stocks. This morning, crude prices are trading mostly flat, down just a nickel at $69.91 currently.

Fuel prices are trading in positive territory with gasoline leading the way higher this morning. Both products saw large gains yesterday with gasoline closing over 2 cents higher and diesel increasing over 3 cents. This morning, gasoline prices are continuing to move higher trading at $2.0791, a gain of over 1.1 cents. Diesel prices are trading with less momentum, gaining just 13 points at $2.1331.

Geopolitical tension continues to heighten as headlines of China and Iran drive the market. China has reportedly refused the US’s request to cut all Iranian imports, however has agreed not to increase Iranian crude imports.

News also surfaced yesterday that Iran is preparing to hold a military exercise in the Strait of Hormuz in the coming days. The US military is concerned it could demonstrate Iran’s ability to shut down the Strait of Hormuz, which they have threatened to do if the US enforces sanctions on crude in November. News of the exercise contributed to yesterday’s rally as oil prices would skyrocket if the waterway were to be blocked.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.