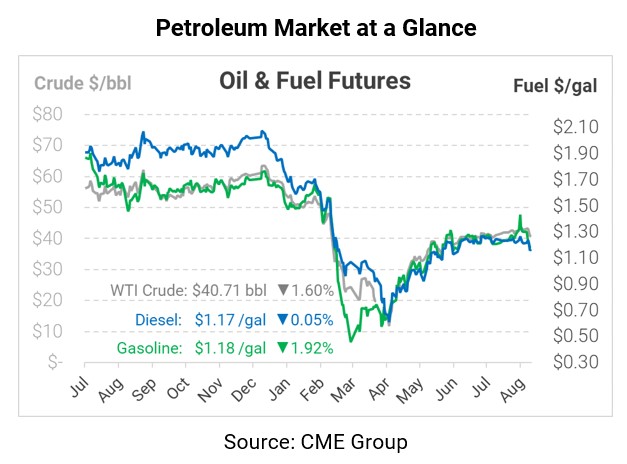

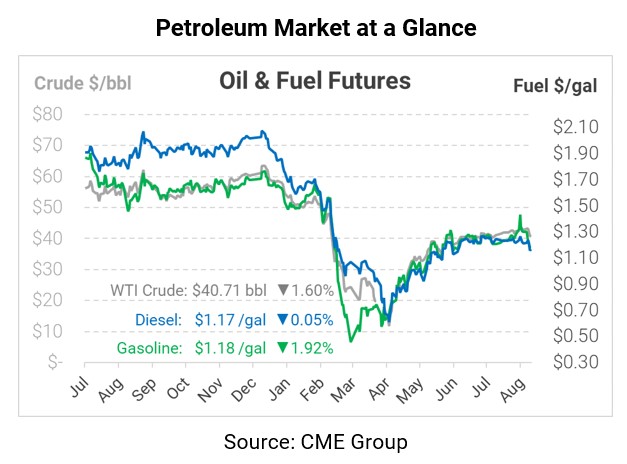

Crude Falls Even as Job Gains Rise

Oil markets tested the $40/bbl threshold yesterday as WTI crude hit $40.22, the lowest oil has traded intra-day since August 4. The product recovered to settle above $41, but traders are closely watching to see if the commodity will break below this key psychological threshold. Today, oil markets are lower once again despite this morning’s payroll report, which outperformed expectations and sent unemployment to just 8.4% in August. But economic recovery, while supportive for markets, cannot outweigh the suppressed demand seen in the EIA’s report earlier this week.

In the US, refiners that were forced to shut off during Hurricane Laura are finally expecting to return to operations in the next few days. This should help alleviate some of the Lake Charles supply challenges, though the abundance of fuel inventories and carrier capacity has prevented the outages from having a more severe effect on markets. Refinery utilization remains low in the US, which will keep a lid on fuel prices for the foreseeable future – any rally in product prices will be quickly met with increased utilization. Like crude markets, threatened by the glut of spare US shale capacity, fuel markets are at the mercy of refineries.

Crude oil is currently trading at $40.71 this morning, shedding 66 cents. Losses for WTI have outpaced Brent Crude, which is nearly $3/bbl above WTI crude now.

Fuel prices are currently trading mixed, with gasoline feeling the brunt of the selloff. Gasoline is trading at $1.1818, down 2.3 cents from Thursday’s closing price. Diesel fuel is trading at $1.1671, mostly unchanged from yesterday.

This article is part of Daily Market News & Insights

Tagged: Economy, Tags: Refinery Utilization

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.