Congress Debates $1 Trillion Stimulus

Yesterday, WTI crude closed up slightly on hopes of a new round of stimulus measures being discussed in the US. A monetary injection into the economy in the form of another stimulus package would give a jolt to the wavering economy as it oscillates between gains and losses due to coronavirus fears. In the crude market, the economic stimulus may help counteract persistent demand concerns; however these demand concerns seem to be leading the market this morning as crude is down in early trading this morning.

Yesterday, Republicans introduced their new stimulus package proposal of approximately $1 trillion called the HEALS Act. Under the “Heroes Act,” the Democrats had previously proposed a $3 trillion+ stimulus package, but Republicans had rejected it as being too big and too broad. The two sides will now discuss and negotiate terms to come up with a final stimulus package which will likely include a direct stimulus payment to individuals, a decreased federal unemployment benefit, and an expansion of the Payroll Protection Program (PPP) among other stimulus.

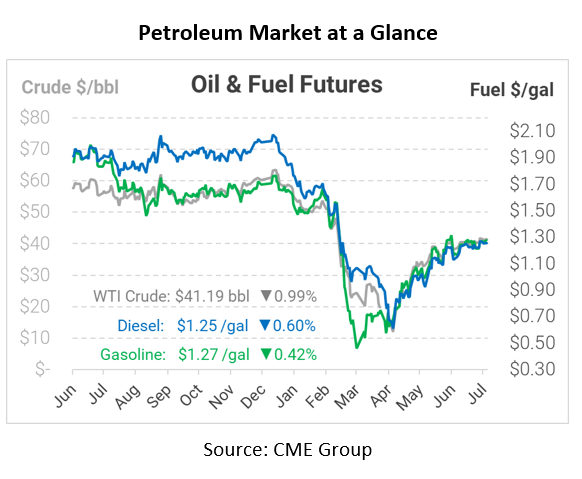

In early trading today, crude prices are down. Crude is currently trading at $41.19, a loss of 41 cents.

Fuel prices are down this morning. Diesel is trading at $1.2466, a loss of 0.8 cents. Gasoline is trading at $1.2694, a loss of 0.5 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.