Colonial Outage – What Happened This Week

Fuel market conditions have evolved rapidly this week in the Southeastern US, with national media sharing news on the situation and the US President weighing in with support. Just one week into the outage, here’s what’s happened this week:

How It Started

On Friday evening, the Colonial Pipeline (CPL) announced a network outage that required them to shut down their systems. At first, the outage seems like a standard outage – pipelines occasionally undergo maintenance or shutdowns, and markets rarely notice. Over the weekend, it became clear this was no ordinary shutdown.

Over the weekend, it became clear the shutdown was the result of a ransomware cyberattack. Although markets lacked clarity at the time, later reports revealed that Colonial paid the ransom within hours of the outage. The remainder of the outage resulted from the operational necessities of safely resuming operations.

By Monday, markets were beginning to take note. CPL could not provide updates on when systems would be restored, only offering a goal of end-of-week for reactivation. With no further details provided, the market began preparing for the worst.

The Outage Deepens

Beginning Monday morning, rack suppliers began cutting off allocations at terminals to stretch fuel inventories for longer. At the same time, consumers began panic buying, stockpiling gasoline in fuel cans, and topping off their cars. Gas station lines began stacking up on Monday and Tuesday. At points on Wednesday and Thursday, as many as 70-80% of retail stations were completely out of fuel.

At the fuel marketer level, terminals running dry forced already limited carrier capacity to funnel through certain markets that still had supply, especially in coastal areas. In addition to delays picking up fuel, trucks faced longer routes since deliveries had to be made from well-supplied markets to dry ones.

Federal policymakers stepped in to assist, waiving regulations such as driver hours limits and truck weight restrictions. The EPA lifted summer gasoline requirements in the Southeast. Individual states also declared emergencies, making it easier to bring in fuel trucks loaded with extra fuel. Georgia temporarily suspended motor fuel taxes, and the IRS announced it would not enforce penalties on using dyed diesel on-road in affected areas.

Pipeline Reopens

CPL announced the pipeline reopening on Wednesday night, although capacity was limited and not all segments were online. By Thursday, the entire pipeline was operational, though it remained at just half-capacity. The pipeline continues working to bring the entire pipeline up to full operations. For now, they’re using manual processes to route fuel to markets.

The Situation Today

With markets beginning to receive fuel, the focus is on resupplying the thousands of bulk fuel tanks currently on empty. Although the pipeline reopening markets the beginning of the end, it does not mark the end of the outage. Most estimates point to improvements for retail fuel supply by early next week, but the broader bulk fuel market may remain strained due to strained carrier capacity and a large backlog of deliveries.

What Happened With Prices

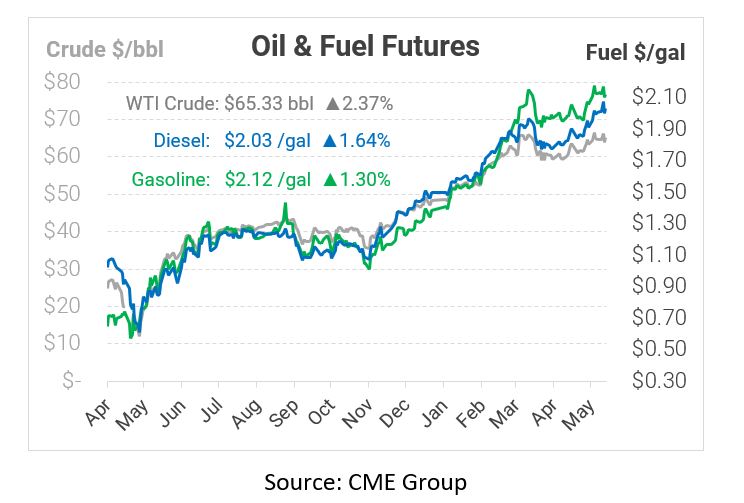

Although the pipeline outage was a critical event for the US East Coast, it was a non-issue for national and global fuel markets. NYMEX crude and fuel prices showed some gyrations, but those were connected to market reports and COVID stats, not the Colonial Pipeline. Fuel prices in the Southeast rocketed higher, but the impacts were confined to that areas. Even NYMEX gasoline and diesel prices, tied to prices in New York Harbor, barely moved – indicating that Northeast inventories remained strong. Indeed, increased fuel exports from Europe have been an ongoing trend this year, which has helped keep the Northeast supplied even as states further south face outages.

This article is part of Daily Market News & Insights

Tagged: Colonial Pipeline, pipeline, Southeast

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.