China’s Iran Oil Purchases Dilute Oil Supplies

Yesterday saw a hefty selloff for oil products, but a late-day buying spree for crude oil held the product to just 20 cent/bbl losses. Refined products saw steeper losses, with diesel shedding 2 cents and gasoline prices tumbling almost 5 cents.

Recent reports have revealed that China is ramping up purchases of sanctioned Iranian oil, with oil flows nearing 1 MMbpd. Purchases appear to be coming from domestic trading shops, rather than private and state-owned refineries, according to Bloomberg. More purchases of Iranian oil displace oil from other areas, resulting in lower prices worldwide. The quantity of Iranian oil is comparable to Saudi Arabia’s voluntary cuts, raising questions over the efficacy of OPEC’s cuts. Before sanctions, Iran exported 2.5 MMbpd of oil, and President Biden is seeking to restart negotiations to curb Iran’s nuclear program and allow their oil to flow to global markets once again.

On the bullish side, the EIA expects US shale production to continue dropping next month, cut back by 46 kbpd compared to March. Even with rising prices and climbing global oil demand, shale producers are holding back, tepidly adding oil rigs but slow to bring new wells online. In the past, shale companies used high prices to fund new drilling activity; now, they’re using the excess profits to pay down debt and increase shareholder returns. OPEC+ production cuts are predicated on the expectation that US shale output stays low; so far, it appears their expectations are holding true.

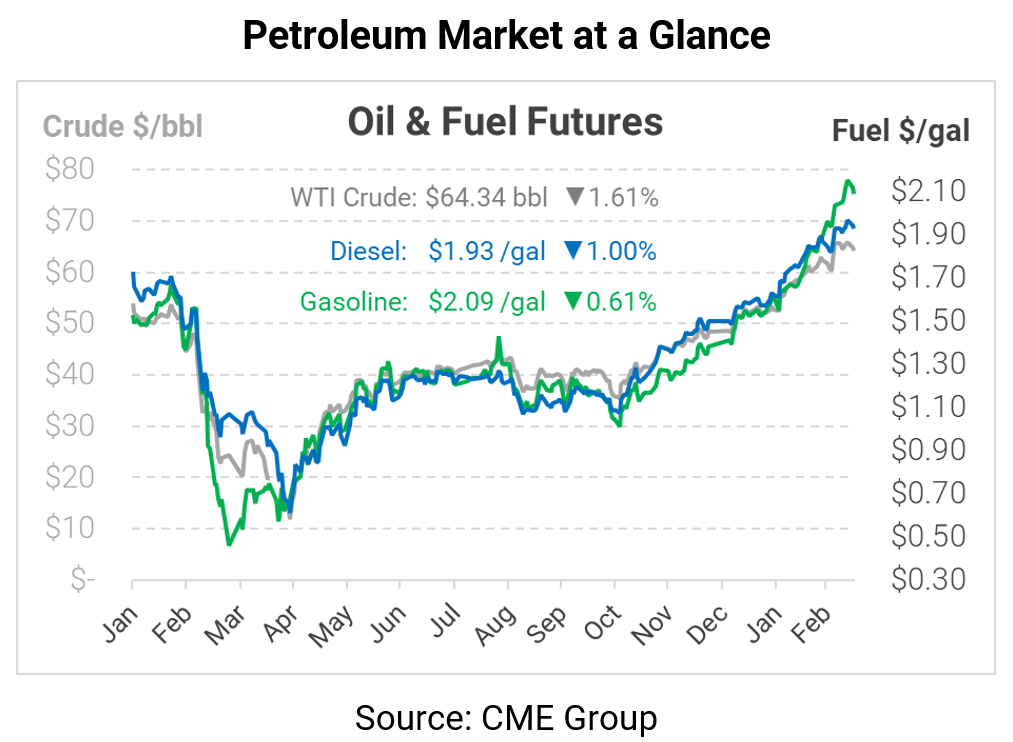

This morning, oil prices are moving lower once again, extending yesterday’s losses. WTI crude is trading at $64.34, down $1.05 (-1.6%) from Monday’s closing price.

Fuel prices are also down a bit this morning. Diesel is trading at $1.9295, down 1.9 cents (-1%) from yesterday’s close. Gasoline is currently $2.0917, down 1.3 cents (-0.6%).

This article is part of Daily Market News & Insights

Tagged: China, Iran, Oil production, Shale

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.