China Oil Demand Down 20%

Anonymous Chinese energy officials have hinted that Chinese oil demand is down by 3 million barrels per day currently – more than ten times original estimates from Goldman Sachs. If confirmed, this loss of 20% of China’s consumption would be the most severe global demand drop since the 2008-09 Great Recession, when oil prices fell to $33/bbl. In 2019, China accounted for 2/3 of global demand growth, so a slowdown there will have major repercussions on oil prices.

China’s Shanghai stock exchange was down more than 7% this morning following the news of slowed economic activity, and China’s Central Bank has committed to cash injections to support the flailing market. OPEC will be meeting this week to discuss a response to dampened demand, though a 3 million barrel per day supply cut is far outside the realm of possibility. Some have speculated additional cuts could be as much as 500 kbpd, though getting Russia on board will be a difficult task for OPEC members. In the past, Saudi Arabia has borne the brunt of production cuts, so expect to see further Saudi concessions.

The virus continues spreading, with the first non-Chinese death reported in the Philippines and the total number of affected individuals rising to over 17,000. With 362 fatalities now reported, the new coronavirus is officially more deadly than the 2002-03 SARS outbreak, which killed 349 over the course of a year. On a more positive notes, the NY Times reported today that nearly 500 have recovered from the illness, suggesting a lower lethality rate than SARS.

On a lighter note, it appears spring is around the corner. In Pennsylvania, the renowned Punxsutawney Phil failed to see his shadow, which is said to be a harbinger of an early spring. This year’s Groundhog Day came on 02/02/2020, the only palindrome date this century. NOAA seems to agree, forecasting above-average temperatures for most of the US (with the exception of the Northern Plains, which may see colder-than-average temperatures).

Daily Market Trends

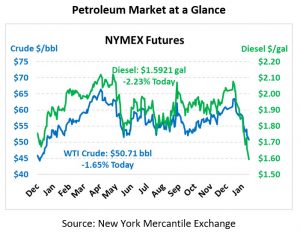

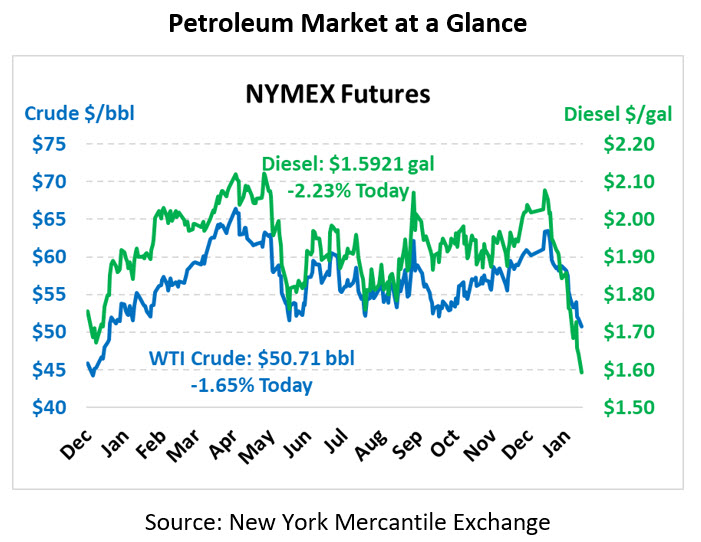

Oil markets continued the streak of losses on Friday, with the complex dropping to $51.56 to close the week. Out of the last 20 trading sessions, 15 have seen daily losses, bringing oil prices from $63/bbl down to barely above $50/bbl in just a few weeks. Crude oil is currently trading at $50.71, down 85 cents from Friday’s close.

Fuel prices are also plummeting. Diesel prices are trading at $1.5921, down 3.6 cents from Friday’s close. Gasoline prices are $1.4788, down 2.5 cents.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.