China No Longer Labeled Currency Manipulator

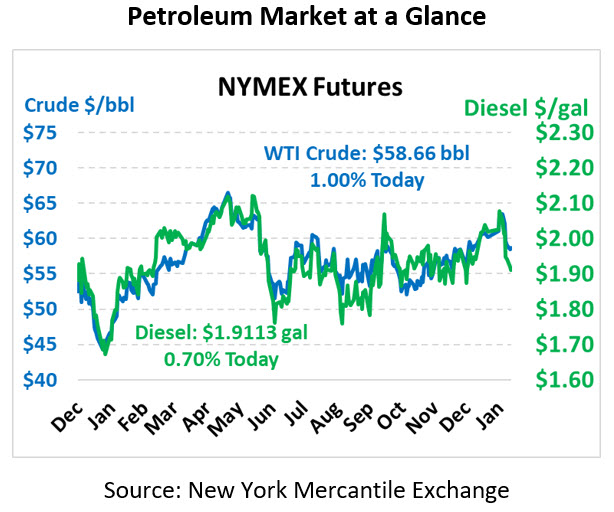

Yesterday markets closed lower – extending to five days the streak of losses. The market appears to have dismissed Middle East tensions in the short term. However, crude is up in early trading this morning. Crude is currently trading at $58.66, a gain of 58 cents.

Fuel prices are up. Diesel is trading at $1.9113, a gain of 1.3 cents. Gasoline is trading at $1.6817, a gain of 2.4 cents.

The Treasury Department announced that China is no longer labeled as a currency manipulator. China is now on a “monitoring list” for currency practices, along with other countries such as Germany and Japan. The move came two days before the U.S. and China are scheduled to sign a phase one trade deal. The signing of a phase one deal marks a major step in ending the dispute that has cut global growth and negatively impacted oil demand. As part of the deal, China also pledged to buy more than $50bn in energy supplies from the US over the next two years.

China’s crude oil imports in 2019 rose 9.5% from a year earlier, setting a record for a 17th straight year, as demand growth from new refineries built last year propelled purchases by the world’s biggest importer. The annual increase equates to 882 kbpd in incremental purchases, largely because of demand from new plants that added 900 kbpd to China’s oil-processing capacity, although some of the units started operating only in December.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.