China Economy Weakens but OPEC Not Concerned

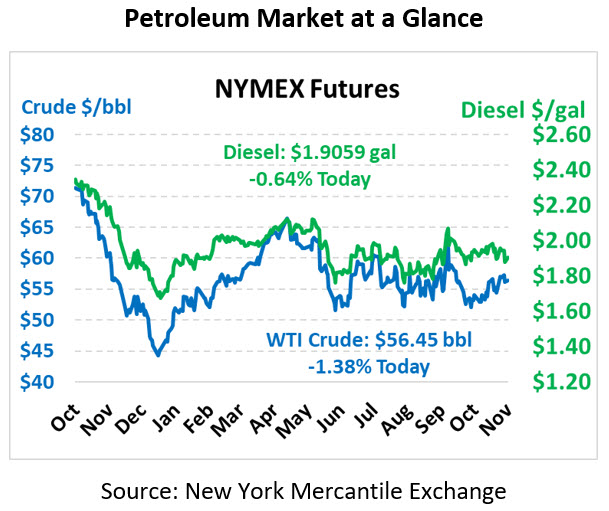

Friday saw some bumpy trading action for oil markets, with oil prices slipping in the morning before rising again heading into the close. Weakened trade sentiments are weighing on oil this morning. Crude oil is currently trading at $56.45, down 79 cents from Friday’s close.

Fuel prices are sinking lower as well after small losses to close last week. Diesel prices are currently trading at $1.9059, down 1.2 cents. Gasoline prices are $1.6208, down 1.3 cents.

This weekend, President Trump clarified that despite progress in trade conversations, the US has in no way agreed to lowering tariffs as part of the Phase 1 trade deal. Earlier reports from Chinese sources had hinted that both parties were discussing lowering tariffs. Now, it seems that Phase 1 may be smaller in scope than markets hoped.

Economic data in China continues weakening, with producer prices and auto sales both lower in October. While the market occasionally latches onto positive Chinese economic indicators, the majority of trendlines point lower. Still, there are some exceptions. Crude imports in October rose almost 7% in October month-over-month, reaching 10.76 MMbpd. Chinese oil producer Sinopec expects imports to reach 9.5 MMbpd this year, 8% higher than 2018 levels. Even as China’s economy is slowing, their oil demand is rising, which could help support oil prices (though rising demand in one country may not offset weakened demand world-wide).

Despite dwindling global oil demand, OPEC members have suggested there’s no need to deepen the group’s oil cuts. Oman’s energy minister indicated the production agreement would be extended into 2020, but likely will not include any steeper production cuts. The UAE shares the lack of concern about long-term demand growth prospects, even if markets temporarily slow down in the short-term. Still, smaller countries like Oman and the UAE have little sway over group decision making; ultimately, Saudi Arabia and Russia will be the key influencers at December’s OPEC meeting.

This article is part of Crude

Tagged: 2020, China, imports, oil prices, Oman, opec, Phase 1 trade deal, President Trump, Russia, Saudi Arabia, Sinopec, UAE, US

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.