China Demand Tumbles, Iran Boosts Output

The oil complex is experiencing steep losses this morning as the factors behind the rally seem to be fading. Last year, China’s recovering fuel demand was a primary force pushing prices higher. This year, several Chinese cities are experiencing rising cases, forcing the country to establish new lockdown policies to curb the spread. China was the first country to see its demand hit by COVID-19, but it was also the first to recover later in 2020. Now, Chinese consumption is in jeopardy again as the pandemic rages in different communities.

Adding to this morning’s losses, Iran’s Deputy Oil Minister Amir Hossein Zamaninia told reporters this morning that Iran is already producing far more than most countries assume, despite strict sanctions by the US. After Trump re-imposed sanctions in 2018, Iran’s crude output fell from around 4 MMbpd to below 2 MMbpd in 2020. Iran is now rapidly bringing supply back online, targeting to return to full output within 1-2 months. The action appears to be an early test of the Biden administration. Treasury Secretary nominee Janet Yellen noted that sanctions would be lifted unless Iran returns to compliance with the 2015 nuclear deal. Iran has before stated that they would not return to compliance until sanctions are lifted.

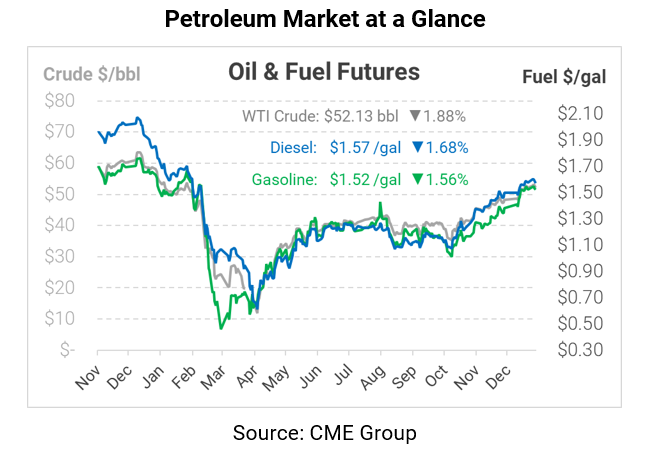

Prices have been on a roller coaster this morning, with crude sinking as low as $51.50 in early trading. Currently, prices have recovered a bit, though they remain lower across the board. WTI crude is trading at $52.13, down $1/bbl from Thursday’s closing price.

Fuel prices, which traded as much as 5 cents lower earlier this morning, are also beginning to climb higher. Diesel is trading at $1.5737 this morning, down 2.7 cents from yesterday’s close. Gasoline prices are $1.5238, down 2.4 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.