Canada to Maintain Production Cap

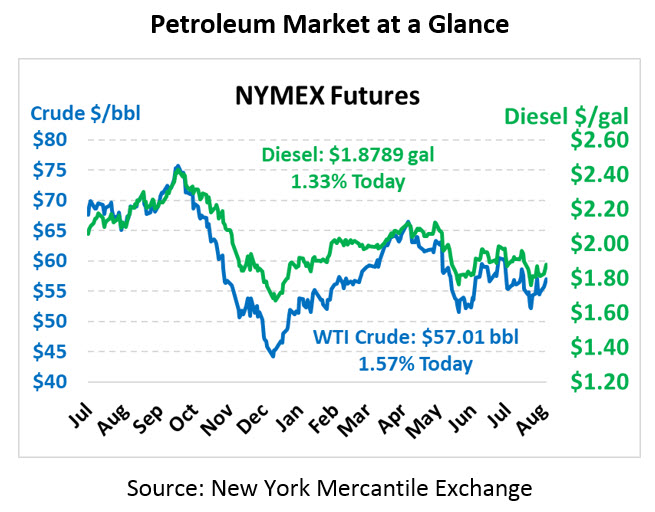

Oil continues its creep higher this morning, ending yesterday relatively slightly higher despite moving lower earlier in the day. Inventory data is the highlight story of the day, along with news from our neighbor to the north. Today crude is trading at $57.01, up 88 cents (1.6%) from yesterday’s close.

Fuel prices are up in line with crude gains. Diesel prices are currently $1.8789, up 2.5 cents (1.3%). Gasoline is at $1.7157, a gain of 3.5 cents (2.1%).

Alberta announced yesterday plans to continue its oil curtailment policy, limiting crude output from the oil-rich province. A number of pipeline project delays, ranging from the Enbridge Line 3 Expansion to Keystone XL to the Trans Mountain Pipeline expansion, have contributed to an on-going glut in supply of Alberta’s heavy crude. The glut is projected to be 150 kbpd in 2020. When the curtailment was first announced a year ago, Western Canadian Select (WCS) crude prices, which trade as a discount to WTI, shot up to the narrowest spread in a decade. With the world struggling with a shortage of heavy crude due to reduced Venezuelan and Mexican supplies, Canada’s crude has grown more important for refineries configured to process the heavier product.

The API yesterday reported its weekly data for oil markets, which is providing support for oil prices. Crude inventories fell 3.5 MMbbls week-over-week, in line with expectations and seasonal trends. Fuel inventories generated little interest, with gasoline barely falling instead of barely rising and diesel rising a bit more than expected.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.