Buy the Rumor, Sell the News

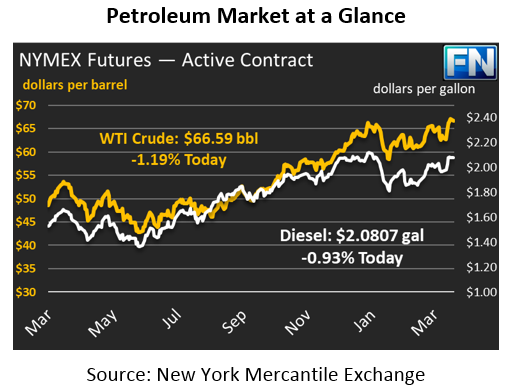

Markets are trading lower this morning despite the strikes on Syria, a signal that traders are removing a portion of the risk premium added last week. Crude oil prices ended at $67.39 on Friday, the highest closing price in years. Today, prices are trading 80 cents (-1.2%) lower at $$66.59.

Fuel prices are also in the red this morning, following crude prices lower. Diesel prices traded as high as $2.10 last week, but today prices are down 2.0 cents (-0.9%) at $2.0807. Gasoline prices are also trading lower, down 2.2 cents (-1.1%) at $2.0431.

Buy the Rumor, Sell the News

The marketplace is reflecting the old trader adage, “Buy the rumor, sell the news.” Last week markets were unsure what Trump would do in response to Syria. He had threated to send missiles, but there was no indication of where or when he would send them. As a result, traders bid up oil prices, expecting a highly destabilizing strike and the possibility of a Russian response.

The “rumors” turned out to be more severe than the actual news. Trump’s attack was coordinated with two major allies to increase credibility and was carefully targeted at chemical weapons manufacturing locations. While John Bolton has taken the position of National Security Advisor, the Syrian response was proposed and influenced by Defense Secretary Jim Mattis, known for having a cooler head. Although much more expansive strikes (including striking all of Syrian President Assad’s military assets and potentially Russian air-defense), a measured yet forceful solution was achieved. In response to the restraint, markets are cooling off this morning.

The market trend is a good reminder that supply and demand does not move markets – traders move markets. Their perception of supply and demand matters more than actual fundamental news. While traders generally try to follow important trends, they can become exuberant, pushing prices either too high or too low. The fact that traders, not fundamentals, move markets ensures volatility will continue, since consensus can quickly shift to a new position.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.