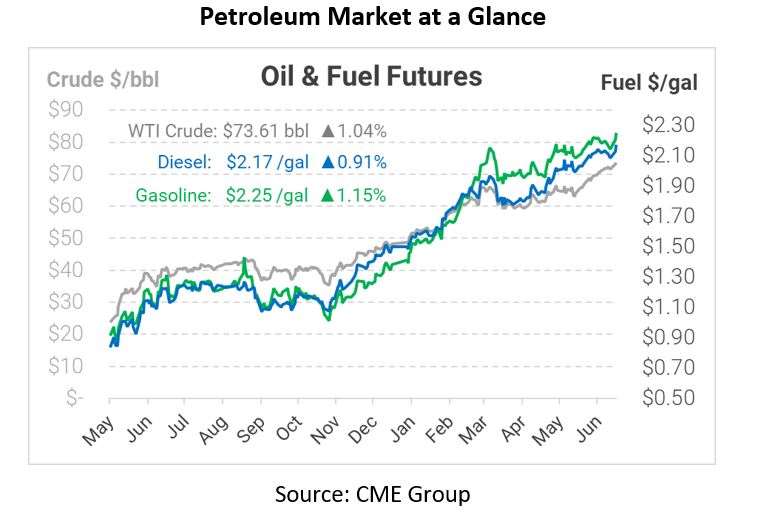

Bullish Bets Rise, Market Weighs Possible OPEC Production Gains

Oil prices fell back yesterday after hitting a new post-pandemic high on Monday. OPEC+ sources hinted at the possibility of increasing supplies in future months to keep up with rising demand. The group has two particularly troublesome dilemmas – the US and Iran. American shale producers are staying on the sidelines for now, but higher prices could prove too tempting. OPEC’s optimal move here is to increase output just enough to alleviate higher prices. On the other side, an Iran nuclear deal could flood the market with supply, taking away the high prices OPEC+ now enjoys. Here, OPEC’s best option is to maintain cuts. OPEC+’s response to those two strategies will be the single biggest factor impacting prices this year.

One thing’s for sure – hedge funds are betting on both OPEC and US shale restraint, with both groups keeping spare capacity offline to focus on cash flow and higher profits. Bullish bets are rising, with many talking about the potential for $100 oil in the next year. Markets often follow sentiment rather than fundamentals, so the $100 bet for oil might just become a self-fulfilling prophecy.

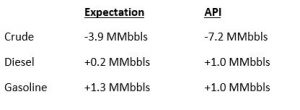

This morning, prices are working their way back up to Monday’s highs as the market anticipates the EIA’s weekly inventory data. Traders expect a notable crude draw, accompanied by small refined product builds – a sentiment echoed by the API. The trend is somewhat counter-seasonal; typically, fuel inventories (especially gasoline) fall during the summer as demand outstrips refiner capacity. This year, refiners are itching to produce more fuel, causing inventories to rise this summer.

This article is part of Daily Market News & Insights

Tagged: API, crude draw, hedge, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.