Biden Says Yes to Federal Land Drilling – Will It Help?

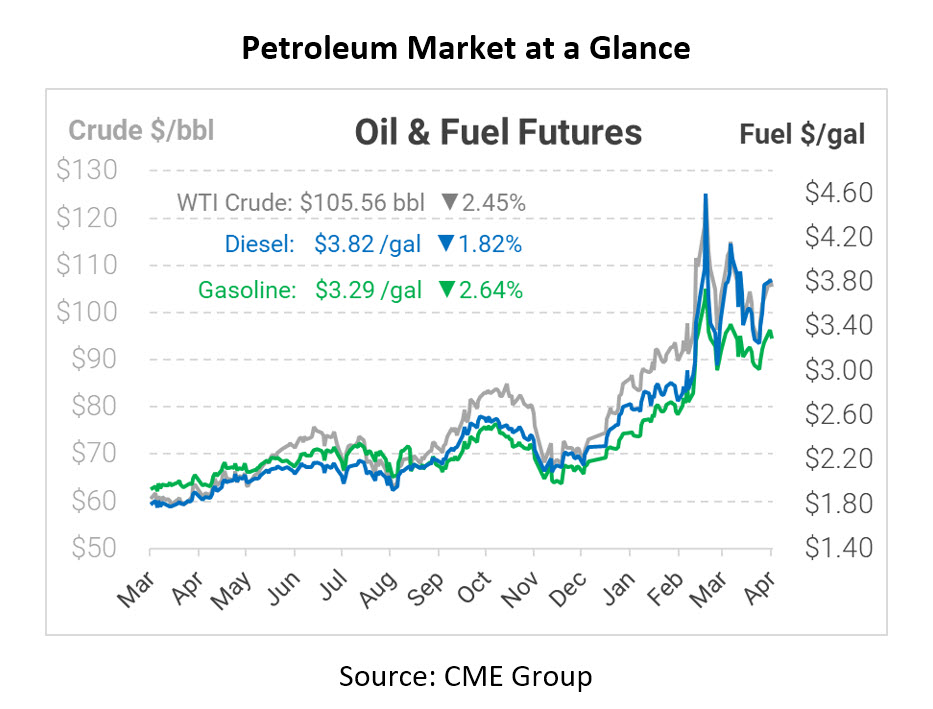

A while back, FUELSNews reported that Biden was turning back toward big oil companies that he once took a stand against to request help driving prices down. Now, in a move that climate activists did not take lightly, Biden is ramping up oil and gas drilling on federal land. Today WTI crude opened at $107.75, diesel at $3.9021, and gasoline at $3.3506. Prices have moved sharply lower this morning from their opening price.

During Biden’s first year as president, he undid Trump-era rollbacks and implemented climate change initiatives that would change the market for some time. The response to these new laws, especially those preventing drilling on federal lands, was mixed. Now, Biden is announcing drilling permits on 144,000 acres of federal land. So, will drilling on federal lands help drive prices down? Yes and no.

After Biden announced pausing new drilling on federal lands, a federal court struck down the order, allowing drilling to continue. In fact, oil permits in public lands in 2021 were 34% higher than in the first year of the Trump presidency. So in the short-term, companies who wanted a permit could get it. But permits slowed in 2022 as oil and gas companies shifted focus elsewhere, seeing the opposition from the administration. Although the permit release won’t immediately cause a surge of production, it provides a strong signal to oil companies that the administration is backing down from its previous threats. That message, far more than the permits themselves, could give producers the confidence they need to invest in ramping up their production.

There is one downside for producers to this new action that Biden has implemented, and that comes in the form of royalties for oil companies. Once drilling begins, oil and gas companies must pay an 18.75% fee on the value that they extract. The previous number in place was 12.5%, so this is a significant price increase in new royalty fees. Whether the new acreage significantly alters US production or not, the change of messaging is sure to be noticed by US producers.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.