Biden in No Hurry to Lift Iran Sanctions

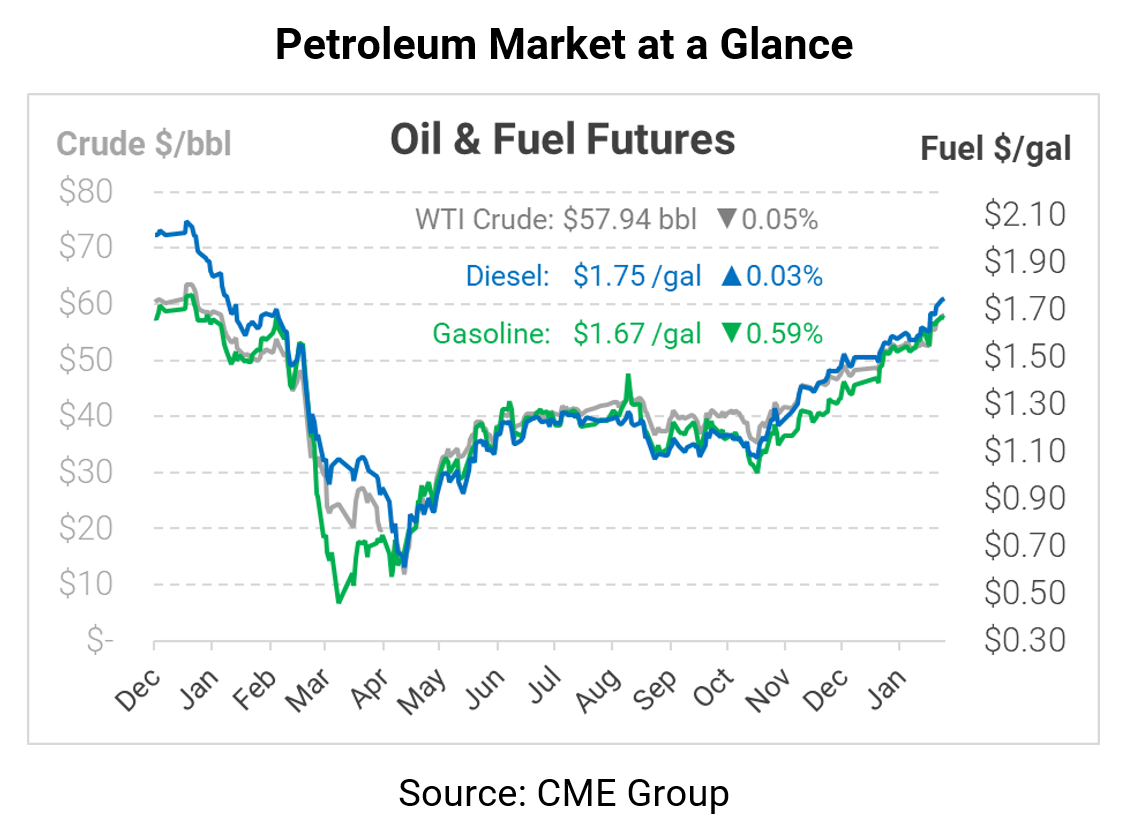

After a run sending WTI crude to the brink of $58/bbl, the streak of gains seems to be coming to an end. Oil prices fell lower in early trading, though market indicators remain unchanged. Supplies remain cut, and stimulus legislation is on its way. Even the US Dollar is providing bullish support today for oil, but traders seem to be taking time to cool off before any further rally can occur.

Earlier this week, President Biden said in an interview that he would not lift Iran sanctions until the country reduces its uranium enrichment program. Many expected the new President would take a more diplomatic approach with Iran, supporting the nuclear treaty signed during the Obama administration. The US and Iran are now at a stalemate – Iran believes the US should lift sanctions before they comply with the deal, while the US believes Iran should comply before sanctions are lifted. Still, both parties want to return to the deal, so don’t expect the stalemate to last forever. In the short-term, political division could stall progress, keeping Iran’s oil supply off the market for the foreseeable future. Markets had been pricing in Iran’s oil coming back soon, so the change in approach gave markets an added boost yesterday.

This morning, oil prices have clawed back some of their losses, bringing prices flat with yesterday. Crude oil is trading at $57.94, down a few pennies from Monday’s closing price.

Fuel prices are mixed this morning. Diesel is trading at $1.7583, flat with Monday’s close. Gasoline is at $1.6650, down 1 cent.

This article is part of Daily Market News & Insights

Tagged: Iran

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.