Biden Considers Lowering Renewable Fuel Requirements

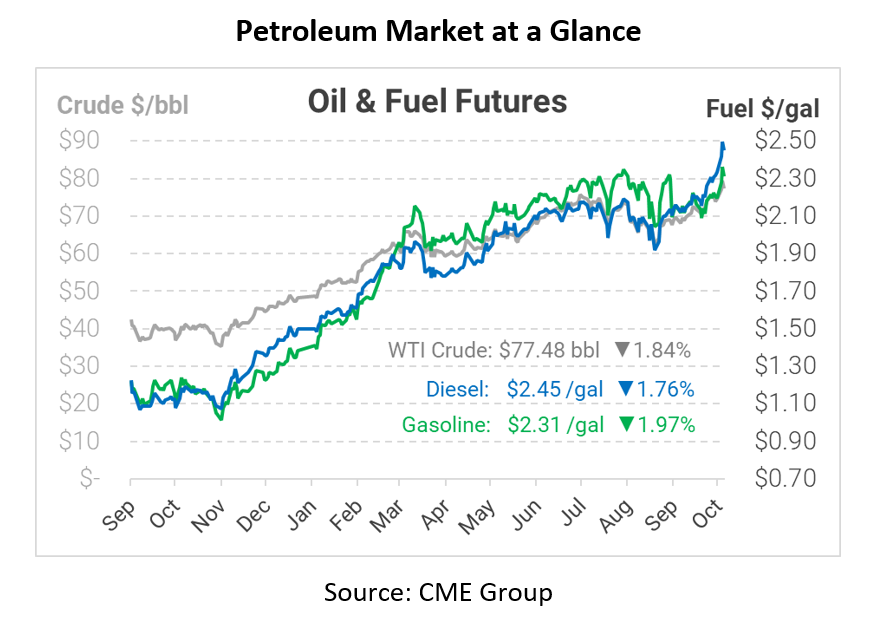

Fuel prices are recovering a bit this morning following yesterday’s 7-year high. Traders are closing out positions to cash in their gains, an action known as profit-taking. At the same time, last week’s filing from the Securities Exchange Commission (SEC), which tracks commodity market trading activity, showed that hedge funds and other institutional investors are increasingly betting on oil, so don’t assume that the rally is done yet. Oil analysts continue calling for at least $90/bbl oil this winter, so traders are betting on further gains.

On the biofuels front, the Biden administration has reportedly been considering lowering renewable volume requirements set by the EPA, a move that would benefit oil refiners. Although fuel demand plummeted in 2020, oil suppliers were still obligated to blend a certain amount of ethanol and other biofuels, or pay others to blend it for them. The EPA had mandated that 20.1 billion gallons of biofuel be blended with petroleum-based fuels in 2020, but is now considering retroactively lowering the requirement to 17.1 billion.

Parties are divided on the policy. Refiners say that high volume obligations are a financial burden, forcing them to pass along higher costs to consumers. Biofuel producers have opposed the plan, arguing that it would be a move backwards environmentally and set a precedent for reducing biofuel blending in the future. For consumers, a change probably won’t have a significant financial impact. Lowering the volume obligation makes petroleum cheaper and boosts refiner profits, but reduces the financial support that helps keep biofuel prices low. Think of it like a seesaw – refiners and biofuel producers are on either side and may see profits rise and fall, but consumer prices stay steady in the middle.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.