As OPEC Weighs Supply Cut, IEA Considers More Emergency Releases

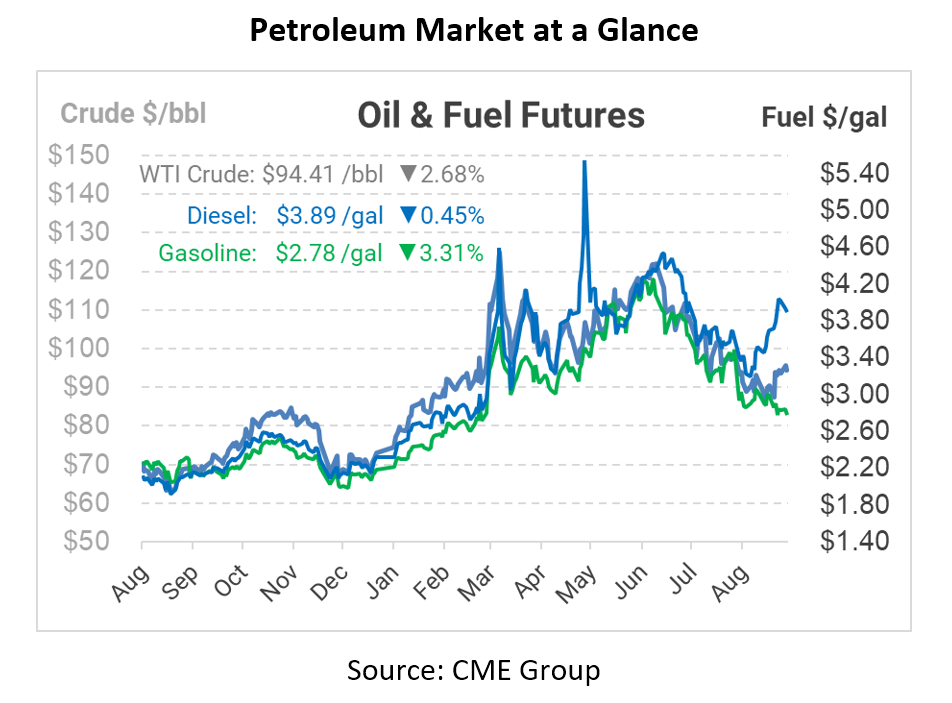

Yesterday, crude prices rose to their highest level in a month. Oil traders continued digesting news that OPEC could slash oil production to offset new barrels flowing from Iran. Saudi Arabia has hinted at the possibility of the group cutting output at its upcoming Sept 5 meeting. As OPEC is discussing production cuts, the head of the International Energy Agency (IEA) noted that emergency stockpile releases could continue beyond their October expiration if prices remain high – a very different assessment of market conditions.

In a recent note to investors, Goldman Sachs hinted that markets could have overreacted to recession fears, especially in the commodities sector. The report mentions that commodities have significant upside over the next 12 months, adding that a recession outside Europe is less likely than commonly believed. Given the pullback, the bank mentioned that current prices represent a “great entry point”, which suggests that now could also be a good time for fleets to consider locking in a portion of their fuel budget with fixed price.

As markets grapple with short-term challenges for energy markets, one thing that’s not going away is the need for fossil fuels to drive the global economy, according to electric vehicle manufacturer Elon Musk. Musk noted that “civilization will crumble” without the continued use of fossil fuels, even while championing a longer-term transition to a sustainable economy. The comments came at a conference in Norway, and when asked about Norwegian investment in oil and gas production, Musk noted that new production is still needed to bridge the gap. As oil majors grapple with transitioning to a clean energy economy without disrupting today’s energy market, the comments are a salient reminder of the importance of the oil and gas industry over the next decade and beyond.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.