As Fuel Becomes a Political Issue, Oil Majors Respond

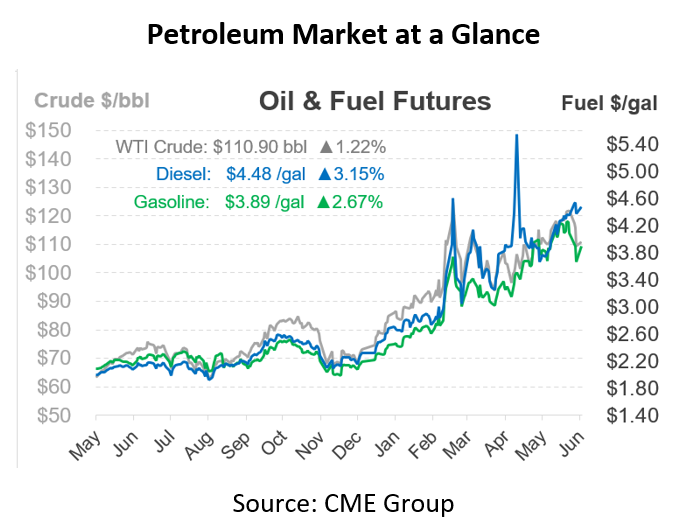

After the long weekend celebrating Juneteenth, fuel prices are up sharply, regaining the 15-20 cents shed last Friday. As pain at the pump continues, political pressures are also ramping up. Last week, President Biden wrote a letter to oil majors, criticizing record high profits and imploring them to somehow increase refining capacity. In response, several oil majors issued direct replies, and the API (American Petroleum Institute) and AFPM (American Fuel & Petrochemical Manufacturers) wrote a reply letter detailing seven realities of oil markets that make increasing refining capacity difficult. Among the highlights of the letter:

- US refineries are at historically high production levels, utilizing 94% of their total capacity. That means refiners are producing more gallons than the US actually consumes. Moreover, many refineries have delayed maintenance projects to keep supply available.

- Roughly half of the refinery production lost over the past few years are being converted to renewable fuel facilities. Eventually, these will provide higher throughputs of products like renewable diesel, though projects will take years to develop.

- Increasing refinery throughput would increase demand for crude oil, which would reduce fuel crack spreads while increasing crude oil prices. Therefore, more fuel production would not necessarily lower fuel prices.

- Refineries are massive, capital-intensive businesses that invest over the long-term. Adding new refineries takes years, and oil majors have cut capacity based on Washington’s clear stance that the world must transition from oil to cleaner energy. Adding new crude oil exploration and refining capacity will require clearer political support for domestic energy production.

The API also provided a list of 10 policy actions the White House could take to show its support for the oil industry.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.