Are Today’s Fuel Prices “Good”?

One of the most challenging portions of locking in a fixed price is choosing the price level you want. Are prices today “good enough” for your fuel budget? How do you know that you’re truly mitigating risk?

Let’s get one important misperception out of the way – you probably aren’t going to lock at the low. It is impossible to know when markets have bottomed out. Prices could change tomorrow and rocket higher; they could also keep sinking. While some people do buy at the low, their fortune is based entirely on luck, not market insight. Don’t wait for the bottom, but through market analysis you can estimate the risks of prices rising versus the risk of prices falling.

This brings up a concept called asymmetric risk. Today diesel prices are trading for roughly $1.75. Which is more likely – that prices fall a dollar to 75 cents (a level not seen since 2003) or that they rise a dollar to $2.75? Clearly, a dollar price rise seems more probable than a dollar drop. This imbalance in probabilities is called asymmetric risk, and right now it seems we have more upside than downside, all things being equal.

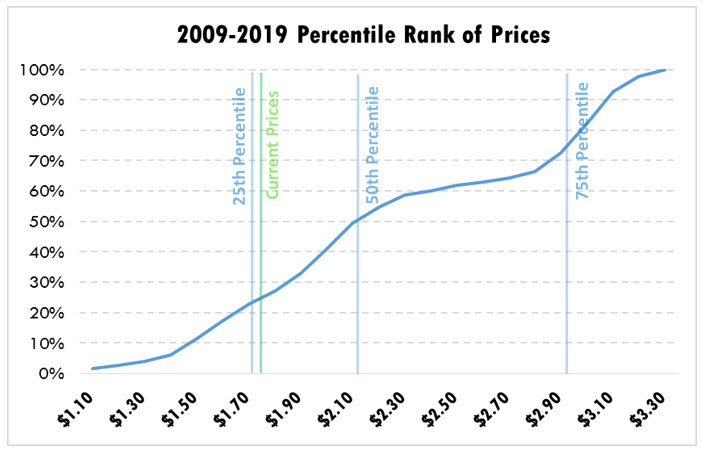

Being more specific, we can see how diesel prices today rank against the past 10 years of prices. Over that timeframe, the 25th percentile is $1.75, meaning that 25% of the time, prices traded below that level. We’re quite close to that point today. A “good” price will certainly be below the 50th percentile, which is roughly $2.11; however, beyond this threshold, individual risk appetites step in. The chart below means that if the next 10 years are similar to the past 10 years, a fixed price at $1.77 will be in the money roughly 75% of the time.

But can we expect the market to behave similarly over the next 10 years? It may be more helpful to narrow our range a bit, given all the market changes of the past few years. If you think of the new oil “era” as starting in 2017 when OPEC resumed its market balancing activity, you can see a fairly similar distribution. Using the past two and a half years as a proxy for the coming 24 months, current prices are at the 30th percentile. That means current prices would be favorable roughly 70% of the time assuming similar dynamics.

Of course, markets are unpredictable. A prolonged recession could potentially suppress prices for longer than expected. Conversely, IMO could cause the next year to be highly volatile with significant upside risk, improving the favorability of current prices. While markets are unpredictable, the recent historical range is the best available data we can use to guess at a “good” level for fixed price. Based on both 3-yr and 10-yr prices, today’s NYMEX level of $2.76 has been in the money roughly 70-75% of the time.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.