API Inventories Show Prolonged Winter Storm Effect

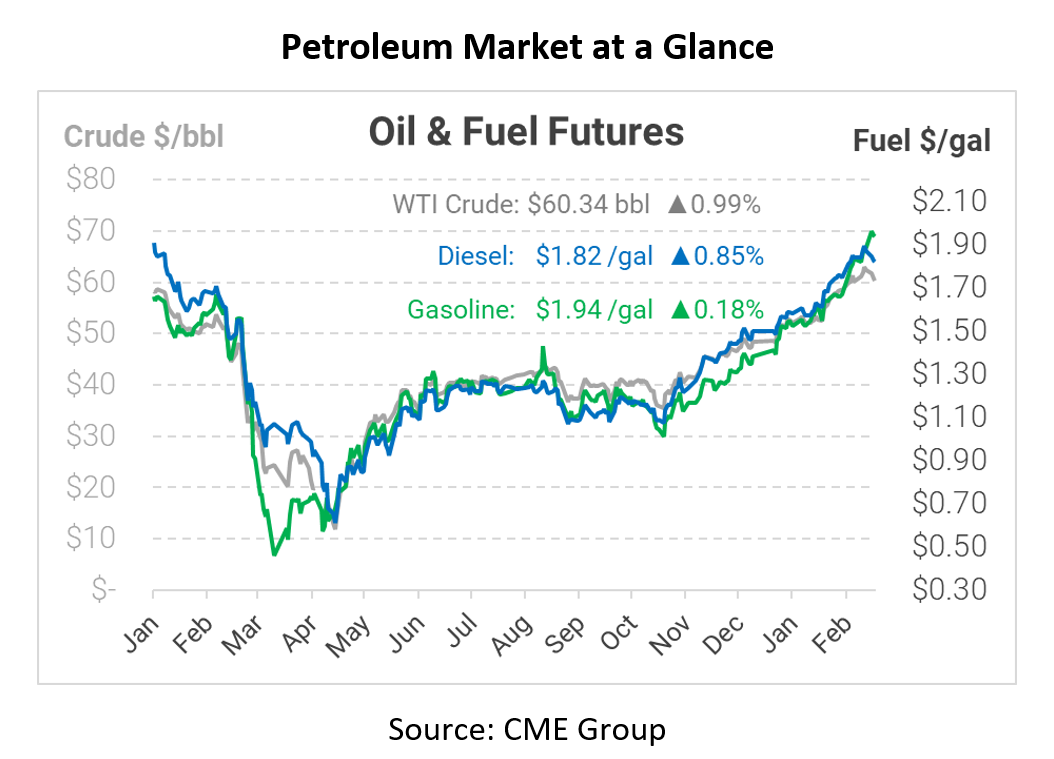

WTI closed below $60/bbl for the first time in almost two weeks, triggered by profit-taking and an expected gain in crude inventories. This morning, prices have popped back above $60/bbl, as bullish traders buy the dip and push prices higher once again. President Biden now claims that all Americans wanting the vaccine will be able to receive it by the end of May. If that estimate holds true, then herd immunity would come right as the summer gasoline season takes off – meaning there’s potential for gasoline demand (and perhaps even jet fuel) to skyrocket, especially if consumers also receive a large stimulus check to fund their travels.

The API’s report last night was in line with the radical results markets had been expecting following the winter storm two weeks ago. Both diesel and gasoline posted huge draws of more than 9 million barrels each, while crude inventories rose steeply. The results reflect delayed refinery restarts, which we detailed yesterday in our Winter Storm Alert. Demand is returning to normal, but refined fuel supply remains limited. With refineries producing less, they’re also leaving more crude oil in storage, causing the hefty build. The EIA will release its more definitive data later this morning.

This morning, crude oil is up above $60/bbl once again, undoing yesterday’s losses. WTI crude is trading at $60.34 this morning, up 59 cents.

Fuel prices are also on the rise this morning. Diesel is trading at $1.8234, up 1.5 cents from Tuesday’s closing price. Gasoline prices are currently at $1.9399, up 0.4 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.