An Explosion in the Night (No, Not Aliens…)

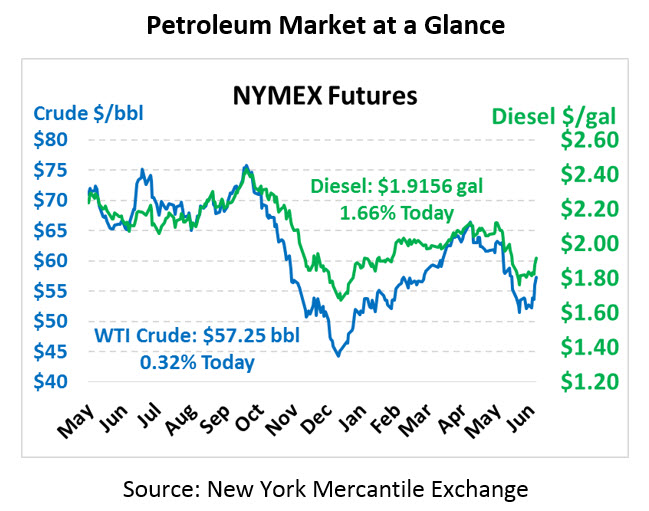

Yesterday marked the largest rally for crude oil this year, with WTI crude surging almost $3/bbl after Iran shot down a US drone. This morning markets remain energized, with fuel leading the way higher. Crude is only mildly up, trading 18 cents higher at $57.25.

Fuel prices are being rocked by refinery issues this morning, causing substantially stronger price action than crude. Diesel is trading at $1.9156, up 3.1 cents (1.7%) and surpassing $1.90 for the first time since May. Gasoline prices are $1.8450, up a whopping 5.9 cents (3.3%).

Philadelphia residents woke to a huge refinery explosion which started around 3-4am this morning. The explosion was triggered at a butane container at Philadelphia Energy Solutions, the largest refinery on the East Coast with processing capacity of 335 kbpd. Geography is important – recall that NYMEX fuel prices are based on NY Harbor deliveries, so the outage comes right in the NYMEX’s backyard. Had a similar explosion occurred in, say, California, the price affects would be more regional.

Yesterday’s rally was more attributable to Iran tensions, and the drama continues this morning. Yesterday Trump attempted to de-escalate the attack by saying someone at Iran had made a “very big mistake” and noting that drone was unmanned so no Americans were hurt. After significant debate among the administration, retaliatory strikes were ordered, but the strikes were cancelled last night just before beginning. Whether new information developed or Trump simply changed his mind is yet to become apparent, as is whether strikes are still on the table or not. Although Iran is not currently contributing much to the global oil supply chain, any conflict in the Middle East threatens oil supplies and will tend to push oil prices higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.