Already a Busy Week for US Foreign Policy

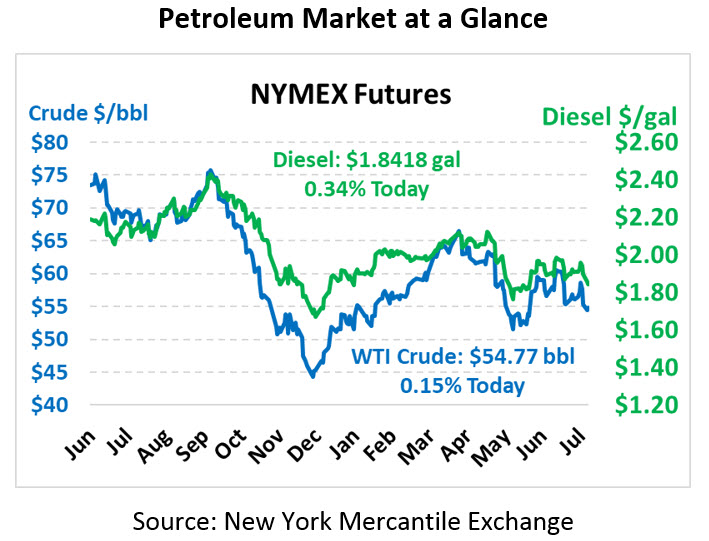

Oil prices see-sawed yesterday, ending the session with roughly $1/bbl losses, while fuel prices saw steady declines throughout the day. Today markets are generally trading flat/slightly higher. Crude is currently at $54.77, unchanged from yesterday’s close.

Fuel prices are moderately higher after hefty losses yesterday. Diesel prices, down 5.5 cents yesterday, are currently trading at $1.8418, up 0.6 cents. Gasoline prices lost 6.4 cents yesterday, and this morning they are trading at $1.7227, taking back half a cent.

It’s been a busy week for the Trump administration, particularly in the foreign policy arena. Just look at three huge announcements we’ve had since the end of last week:

- US Labels China “Currency Manipulator”

Last night, the US labelled China a “currency manipulator” for the first time in 25 years, a sign of the relationship’s deterioration. While China-bashing has been a core campaign promise for many candidates over the years, it’s been quite some time since any President has actually gone so far to officially accuse China of manipulating its currency. The move comes after China’s currency fell to 10-year lows, with a 7:1 ratio with the US dollar.

Typically, such a label would result in trade discussions, an appeal to the IMF, and eventually tariffs. While the Treasury Department is making an appeal to the IMF, the other items were already in place, so there won’t be much concrete action following the designation. Still, China’s central bank acted and affixed the yuan’s reference point to a stronger level, reversing Monday’s steep drop in valuation.

- Trump Tightens Sanctions on Venezuela

This week Trump signed an executive order imposing stricter sanctions on the Venezuelan government and freezing their assets in the US. While previous sanctions were targeted at head officials and key state-run entities, this latest round bans anyone from trading with those groups, bringing it in line with sanctions on Iran, Cuba and others. The tighter sanctions will put continued pressure on the Maduro regime, which 50 countries have now deemed illegitimate.

Venezuela’s oil output is already so low, it would be hard for sanctions to cut production lower – so from a fuel price standpoint, don’t expect much reaction. But if the latest sanctions speed up regime change, then the US might lift sanctions during a transition to prop up Gauido as the new leader.

- 30-Year Old US-Russia Nuclear Treaty Ends

Admittedly this one may not have been as top of mind for you, so for a refresher check out this recent NY Times article. The US withdrew on Friday from the Intermediate Nuclear Forces Treaty, which was an agreement with Russia to ban intermediate-range missiles. To be fair, Russia has never honored the agreement, building over 100 such weapons. China, which was never a party, has thousands. America’s getting back in the game to catch up our weapons capabilities.

Some warn that abandoning the treaty could lead to a new arms race, while others point out that the arms race has already begun and we’re late. Intermediate-ranged weapons provide significant tactical benefits for troops, and when armed with nuclear yields can prove both precise and deadly. This foreign policy update has very little to do with oil – but it’s scary, and scary things can swell up unexpectedly to cause market angst.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.