All Eyes on OPEC+ Meeting Today

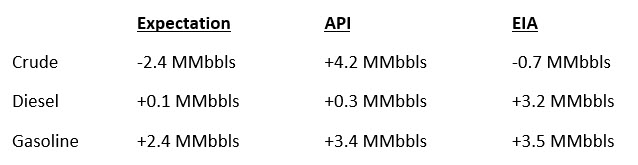

WTI crude closed higher yesterday on EIA inventory news that was more bullish than what the API reported. The API expected a large build in crude, but the EIA reported a small draw. Products had a seasonally expected increase as refiners build stocks in preparation for the spring and higher future demand. Crude is trading sideways this morning as everyone waits on the outcome of the OPEC+ meeting today.

OPEC+ continues to dominate the headlines this week. The group moved its scheduled meeting from Tuesday to today. In today’s meeting, discussions will revolve around continuing current supply cuts of 7.7 MMbpd into next year. The UAE has voiced concerns over market share while the Saudis, the de facto leader of OPEC, are more focused on price.

The UAE has recently received outside investment to increase crude production. These foreign investors are expecting returns. Currently, the UAE is producing crude at one third below capacity. While price is important, the UAE enjoys one of the lowest costs to produce crude in OPEC+. With Biden pushing greener policies and the world moving to lower-carbon alternatives, the UAE wants to use as much of their crude reserves as possible, not to be left with stranded assets.

The EIA reported a decrease for crude of 0.7 MMbbls, compared to an expected decrease of 2.4 MMbbls. At Cushing, the EIA reported that stocks decreased by 0.3 MMbbls. US crude oil inventories are about 7% above the five-year average for this time of year. Distillates reported a draw and continue to trend roughly 8% above the five-year average. Gasoline inventories had a build and are about 4% above the five-year average.

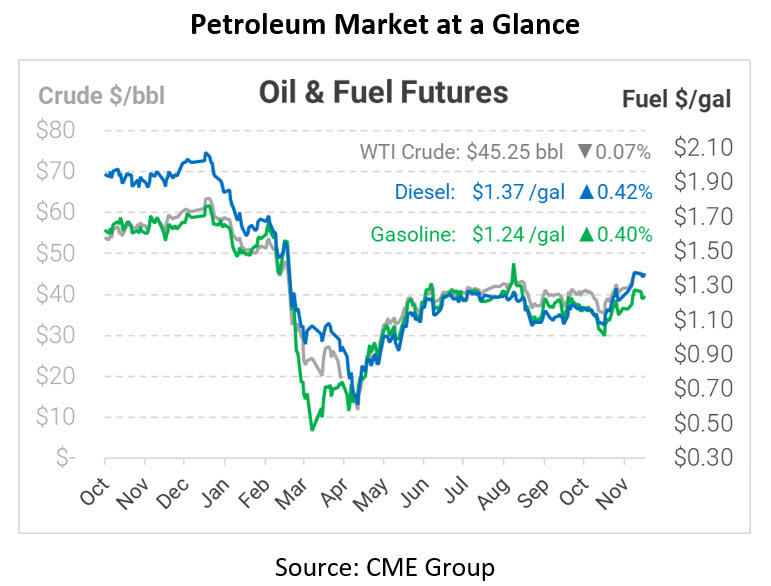

Crude prices are flat this morning. WTI Crude is trading at $45.25, a loss of 3 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.3719, a gain of 0.6 cents. Gasoline is trading at $1.2449, a gain of 0.5 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.