Afghanistan and Oil Prices: A Historical Look

Trouble in Afghanistan. It is something that for the past 20 years we have heard time and time again ever since the United States first responded to 9/11 by invading the region. Since then, peace has been a word far removed from both sides’ vocabulary. Even when eventually deciding to pull out of Afghanistan, 13 Americans were killed in the single deadliest attack on American service members in a decade, all while trying to save as many people as they could.

As Afghanistan descends into chaos, oil prices have been oddly calm. In 2001, oil prices spiked immediately following 9/11, but actually calmed just a week after the attacks. Since then, instability in the Middle East has been a fixture of oil markets. After all, Middle Eastern countries account for nearly 1/3 of all global oil production. So why hasn’t the American withdrawal from Afghanistan, and the resulting power vacuum, triggered a major oil price reaction?

The answer is more complex than it may seem. Right now, there is still a glimmer of order due to the United States military being in the region, but that will not last. According to some analysts, the region is calm for now because the Taliban still does not have 100% control of Afghanistan; however, once the US fully withdraws, it will be a completely different story. The main issue does not lie within Afghanistan, but with the oil giants around them such as Saudi Arabia and the UAE. A growing fear is that the turmoil caused by terrorist groups such as the Taliban and ISIS could spill over into these countries. If this were to happen, oil prices would likely see a sharper upward response.

Narendra Taneja, an energy expert in the Middle East says, “If the turmoil is restricted within Afghan boundaries, the impact (on oil prices) would be limited. But if Afghanistan continues to be on the boil, and boil violently, the oil-producing regions of the Middle East and Central Asia could get affected and, consequently, oil prices”. So, there you have it. The relationship between Afghanistan and oil prices is not direct, but indirect. Events in the region seem to affect oil prices more than other areas due to its war-torn history. Over the coming months we should begin to see whether the United States pulling out of the region will have a more severe impact on oil prices.

Prices in Review

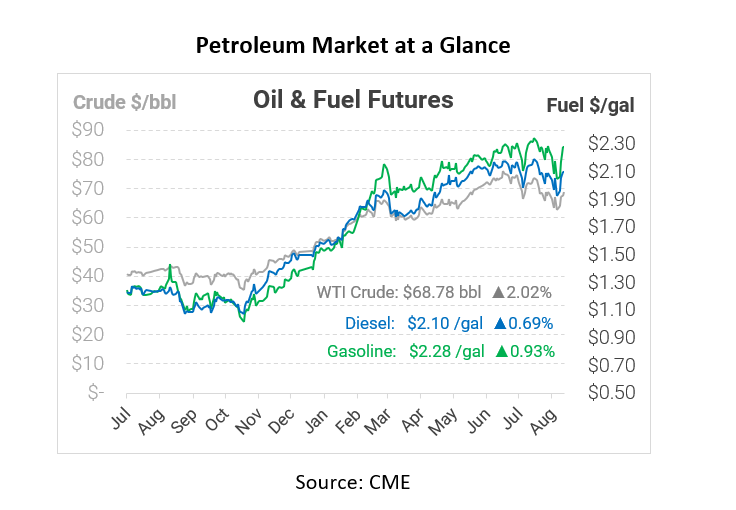

WTI Crude opened the week at $61.96. It opened down from the week prior then tracked steadily upward throughout the week. Crude opened Friday at $67.75, an increase of $5.79 from Monday.

Diesel opened the week at $1.8970. It rose throughout the week with Thursday being the highest price but pulled back again Friday morning. Diesel opened Friday at $2.0801 a gain of $0.1831 from Monday.

Gasoline opened the week at $2.0101. It followed crude throughout the week to close the week higher, with Thursday being the peak. Gasoline opened Friday at $2.2570, a gain of $0.2469.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.