A Bullish Bank Forecast despite Bearish Headlines

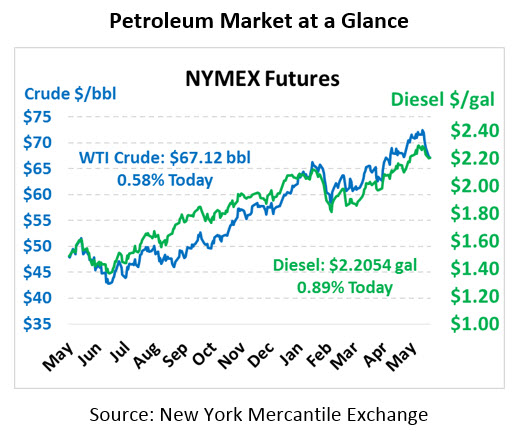

Prices are moving higher this morning after two days of major sell-off. Crude traded down during yesterday’s session, closing the day 82 cents lower. This morning, oil prices have gained 39 cents to trade at $67.12 currently.

Fuel prices are also showing gains this morning, tracking crude higher. Both products saw losses on Monday with diesel ending the day 1.41 cents lower and gasoline 2.6 cents lower. However, prices are recovering some of their losses this morning. Diesel is up 1.95 cents (.89%), trading at $2.2054. Gasoline prices are up to $2.1660, a gain of 2.19 cents (1.02%).

Goldman Sachs Remains Bullish Despite OPEC Chatter

Although prices plummeted following news of a possible increase in production from OPEC and non-OPEC countries, Goldman Sachs is holding to its bullish price forecast for Q3 2018. Goldman is predicting Brent will be $82.50/bbl next quarter. The research report supporting their bullish view despite the current headlines points out the fact that oil markets are already tight and the size of the production increase has yet to be determined.

Further, the bank notes that even if output increases by 1mmbpd, it would merely offset some involuntary losses from members of the group. Historically, OPEC has implemented gradual increases in production, meaning additional product could enter the market at a slower rate, keeping supply tight and prices elevated through Q3. Finally, Goldman researchers believe ongoing disruptions in Venezuela and the possible loss of Iranian exports could offset any production increases through the remainder of the year. “Without additional increases in OPEC and Russia production in 2019, inventories would fall to critically low levels by the end of the year” the report said. Goldman will stick to its bullish price forecast.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.