A Bearish API Report and a Kidnapping

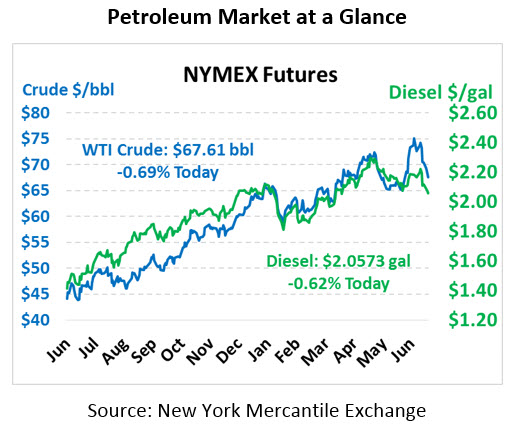

The oil market is continuing its downward trek this morning following a bearish API report. Crude saw some slight volatility yesterday before closing the day mostly flat. This morning, crude is trading lower, giving up 47 cents to trade at $67.61. For perspective, crude opened $6.59 higher just one week ago.

Fuel prices are also moving lower, retracting some of yesterday’s mild gains. Diesel is down 1.3 cents and is currently trading at $2.0573. Gasoline has fallen by 1.1 cents to trade at $2.0147 this morning. Fuel prices opened over 15 cents lower this morning than last Wednesday.

There is a lack of market-moving news this morning as the market anticipates the EIA report coming out shortly. In international news, Libya’s National Oil Corporation declared force majeure on an export terminal in Zawiya after two oil workers were kidnapped from the Sharara oil field causing output to fall 125 kbpd. Meanwhile, two crude units in Venezuela are scheduled to undergo maintenance in the next few weeks, further reducing Venezuela’s processing capacity.

The API reported builds across the board. Crude built by 0.6 MMbbls, surprising the market which expected a decent draw for the week. Gasoline built by 0.4 MMbbls while diesel built by 1.7, bringing products to a net 2.1 MMbbls build.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.