A Bad Day for Pipelines

Today is a bad day for pipelines. The Colonial Pipeline, the main line supplying the East Coast with gasoline, diesel, and jet fuel, remains offline – more on that below. Today, the Enbridge Pipeline faces a critical deadline. The line transports crude oil from western Canada down to Sarnia, Ontario (passing through Minnesota, Wisconsin, and Michigan). Citing environmental reasons, the Michigan’s governor ordered the pipeline to cease operations in 180 days, ending today. So far, Enbridge refuses to shutdown unless they receive the order from federal regulators. The conflict will be settled in court – but a ruling to close the pipeline would be particularly ill-timed now, given supply concerns in the southeastern US.

The Colonial Pipeline posted an updated last night, which reiterated its ongoing efforts to reopen without providing further guidance on the timeline. So far, the pipeline has not changed its guidance from earlier this week, which stated they had a goal of “substantially restoring” operations by the end of the week. If that happens, it will still take a couple weeks for markets to catch up, since the pipeline takes 15 days to ship from Houston up to New Jersey.

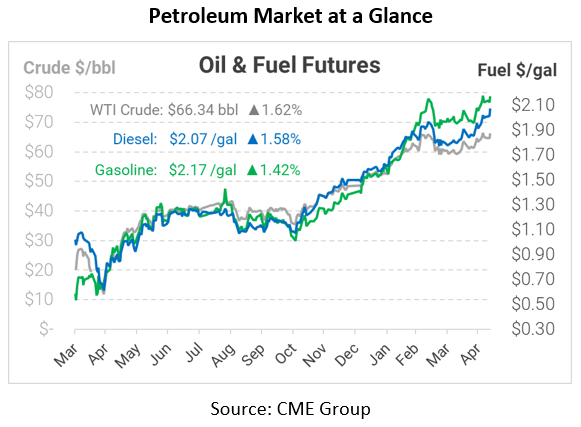

The EIA released their weekly data for the week ending last Friday. The API’s data, reported last night, was supportive for prices, but the EIA’s numbers were somewhat of a disappointment. Crude inventories fell by just 0.4 million barrels, while gasoline posted a surprise build. Diesel was the only product that was more bullish than expected, with a 1.7 million barrel draw.

Although the EIA’s weekly report was bearish, the monthly reports published by the IEA and EIA were both bullish. The IEA expects oil demand to climb by 6.5 MMbpd from Q1 levels. On the other end of the fundamentals equation, the EIA only expects oil production to grow by 3.8 MMbpd (assuming OPEC maintains its current strategy).

This article is part of Daily Market News & Insights

Tagged: Colonial Pipeline, crude, diesel, eia, Enbridge Pipeline, gasoline, jet fuel, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.