2021 Hurricane Season to be “Above Average”…Again

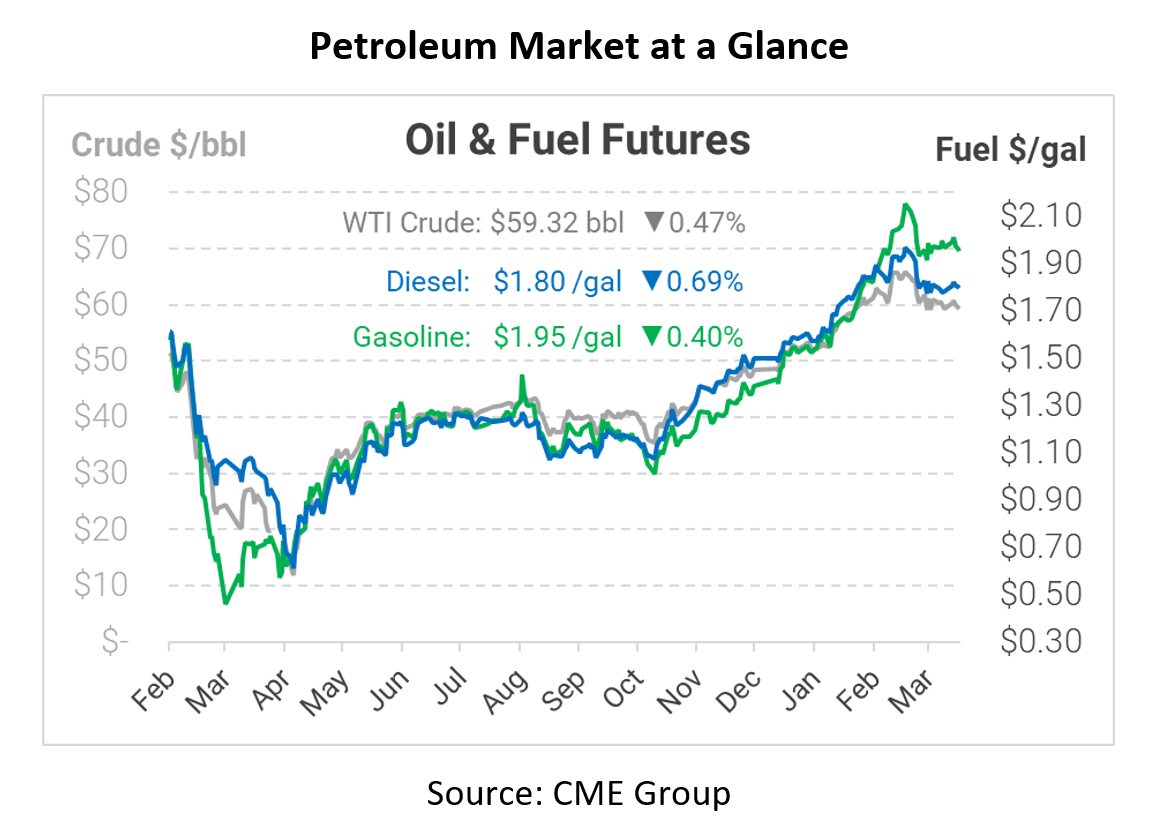

Oil trading action is relatively calm this morning, easing from choppy trading earlier this week. Although recent focus has moved to US unemployment claims, Iranian oil hitting the market, and COVID-related restrictions in some countries, there’s still plenty of optimism that demand is recovering.

Yesterday, Colorado State University released its first outlook for the 2021 hurricane season. Following 2020’s devastating 30 named storms (12 is average), all eyes were on the report. CSU is forecasting a sixth straight “above average” season this year, with 17 named storms and 8 hurricanes. Last year, relentless hurricanes ravaged the Gulf Coast; however, extremely low fuel demand caused by COVID muted the impact. With demand resurging and driver capacity tight nationwide, an active hurricane season could prove far more damaging this year. If you don’t have an emergency fuel policy in place, start now!

In biofuel markets, Reuters warned today that the global trend towards cleaner fuels has put pressure on biofuel feedstocks. With more areas pushing for low-carbon or carbon-neutral policies over the next 15 years, biofuels will become an even more important energy source. But keeping up with the demand will require farmers to grow more crops like soybeans, while used cooking oil collection efforts will need to ramp up. According to the article, renewable diesel output will 4x to 2.6 billion gallons over the next 3 years, requiring 17 billion pounds of incremental feedstock. For consumers, now may be a good opportunity to get ahead of the trend and lock in a long-term biofuel supply contract.

The Dakota Access Pipeline, which has recently faced controversy, is back in the news. Over a year ago, a court ruled that the pipeline did not have an adequate environmental assessment before going online, so the US Army Corps of Engineers began an environmental assessment on the pipeline. Today, they give their report on whether operations should continue. The pipeline moves nearly half a million barrels of oil per day from North Dakota’s Bakken Shale region down to Illinois for refining. Proponents of the pipeline say it is a critical source of oil for Chicago-area refiners, while opponents argue the pipeline is a threat to Native American drinking water supplies. Unlike the Keystone XL ruling, the Dakota Access Pipeline is currently operational, so a ruling to shut it down would disrupt fuel supplies and could send Midwest fuel prices higher.

This article is part of Daily Market News & Insights

Tagged: Biden, biofuels, COVID, Dakota Access Pipeline, hurricane, renewable diesel

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.