$2 Trillion Stimulus Package to Jolt Economy

Yesterday, crude prices were up. They were supported by actions taken by the US Federal Reserve to bolster the economy and the hopes for a coronavirus aid package from congress.

In the early hours of Wednesday morning the White House and Senate reached a historic $2 trillion stimulus deal amid growing coronavirus fears. The over $2 Trillion-dollar package will provide a jolt to the struggling economy. Details of the package have been agreed to and include $250 billion set aside for direct payments to individuals and families, $350 billion in small business loans, $250 billion in unemployment insurance benefits and $500 billion in loans for distressed companies. A vote on these measures will happen later today and is expected to pass.

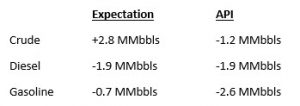

The API’s data last night:

API numbers showed a surprising draw in both products and crude. The API reported a surprise draw for crude of 1.2 MMbbls versus an expected build of 2.8 MMbbls. The API reported that gasoline had a larger-than-expected draw and distillates had a draw in line with estimates. The EIA will report numbers later this morning.

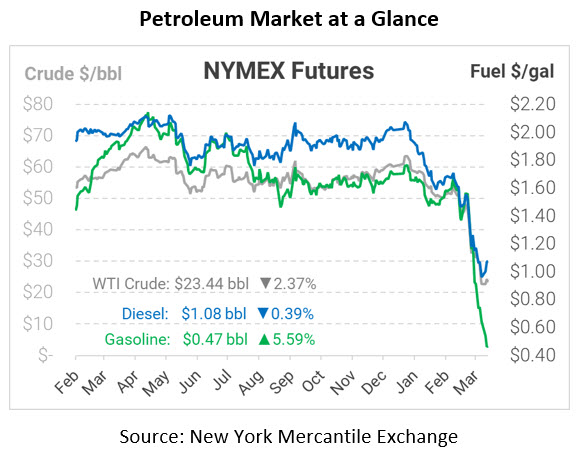

Crude prices are down this morning. WTI Crude is trading at $23.44, a loss of 57 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $1.0761, a loss of 0.4 cents. Gasoline is trading at $0.4685, a loss of 2.5 cents.

This article is part of Coronavirus

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.